7 Best Accounting Software for Traders

Trading is a fast-paced industry where every second counts. With the ever-growing complexity of financial markets, traders need all the help they can get to stay ahead of the game. Enter accounting software for traders – the unsung hero of the financial world. This innovative tool not only streamlines the accounting process but also helps traders make informed decisions, reducing the risk of errors and saving valuable time. In this blog post, we will explore the features and benefits of the best accounting software for traders and why it is an essential tool for anyone looking to succeed in the trading industry. So buckle up, and get ready to discover the power of technology in trading!

Best Accounting Software for Traders

- QuickBooks

- Xero

- Zoho Books

- FreshBooks

- Wave

- Sage 50cloud

- Kashoo

1. QuickBooks Online

Pricing starts at $25/month

QuickBooks offers a range of pricing plans to accommodate the needs of different businesses and traders. The pricing options are as follows:

Simple Start: This is the most basic plan and starts at $20 per month. It includes features such as invoicing, expense tracking, and financial reporting.

Essentials: This plan starts at $35 per month and includes additional features such as time tracking and the ability to track sales tax.

Plus: This plan starts at $70 per month and includes inventory management and the ability to track project profitability.

Advanced: This is the most comprehensive plan and starts at $150 per month. It includes features such as job costing, dedicated support, and the ability to track billable hours.

All QuickBooks plans include a 30-day free trial and a money-back guarantee. The pricing for each plan can vary depending on the number of users and the level of support required. Traders and businesses can choose the plan that best fits their needs and budget.

Best All-In-One Financial Management Solution

QuickBooks is best for businesses and traders who need an all-in-one solution that can handle their financial management needs and provide them with the tools to make informed business decisions.

Highlights and Hidden Gems of QuickBooks

- Integration with other business tools: QuickBooks integrates with popular business tools such as PayPal, Square, and Gusto, allowing for streamlined workflow and improved accuracy in financial reporting.

- Robust financial reporting: QuickBooks provides a range of financial reports, including profit and loss statements, balance sheets, and cash flow reports, giving users a comprehensive view of their financial situation.

- Dedicated support: QuickBooks offers dedicated support for its advanced plan users, ensuring that businesses and traders have the help they need to successfully use the software.

- Wide range of features: QuickBooks offers a wide range of features, including invoicing, expense tracking, tax preparation, and financial reporting, making it a comprehensive solution for financial management.

Disadvantages and Limitations of QuickBooks

- Limited stock management features: QuickBooks is not designed specifically for traders and, therefore, may not have all the stock management features that traders need. This can result in a lack of detailed reporting and tracking of stock transactions.

- Limited international capabilities: QuickBooks is primarily designed for businesses operating in the United States and Canada, and its international capabilities are limited. This may make it difficult for traders who operate in other countries to use the software effectively.

- Limited inventory management: While QuickBooks does offer inventory management features, they may not be as robust as those offered by other accounting software specifically designed for traders. This can make it difficult for traders to effectively track and manage their inventory.

2. Xero

Pricing Starts at $9/month

Xero is a cloud-based accounting software that offers a range of pricing plans to suit the needs of different traders. The pricing plans for Xero start at $9 per month for the Early plan and go up to $70 per month for the Premium plan.

The Early plan is suitable for solo traders and small businesses who need basic accounting features, such as invoicing, expenses, and bank reconciliation. The Standard and Premium plans are more comprehensive and offer additional features such as multi-currency support, project tracking, and inventory management.

It’s important to note that Xero’s pricing is based on the number of invoices, bills, and quotes that a trader needs to process each month. If a trader exceeds their monthly limit, they may need to upgrade their plan or pay additional fees.

Overall, Xero’s pricing is competitive compared to other cloud-based accounting software, but traders should consider their specific needs and budget when choosing a pricing plan. Xero offers a free trial for its software, allowing traders to try it out before committing to a paid plan.

Best for Multi-Location Businesses

Xero is a cloud-based accounting software that is best suited for small businesses, freelancers, and solo traders. It is especially useful for businesses that operate in multiple locations or need to access their financial information from anywhere, as Xero can be accessed from any device with an internet connection.

Highlights and Hidden Gems of Xero

- Cloud-based access: Xero is a cloud-based accounting software that allows traders to access their financial information from anywhere, at any time, from any device with an internet connection. This makes it easy for traders to manage their finances while on the go.

- Multi-currency support: Xero offers robust support for businesses that operate in multiple countries and currencies, making it a good choice for international traders.

- Bank reconciliation: Xero automates the bank reconciliation process, allowing traders to easily match their bank transactions with their accounting records. This saves time and reduces the risk of errors.

- Reporting and analytics: Xero provides traders with real-time financial insights, including cash flow reports, profit and loss statements, and balance sheets. This makes it easier for traders to understand their financial performance and make informed decisions.

- Excellent customer support: Xero provides excellent customer support, with 24/7 phone and email support and a range of online resources and guides. This helps traders to get the help they need when they need it.

Disadvantages and Limitations of Xero

- Limited inventory management: While Xero offers basic inventory management features, it may not be sufficient for traders with complex inventory needs. For example, Xero does not provide advanced features such as stock-level tracking and reorder alerts.

- Steep learning curve: Xero is a comprehensive accounting software that can take some time to master. This can be especially challenging for traders who are new to accounting software or who have limited experience with bookkeeping.

- Limited customization options: Xero has limited customization options, particularly when it comes to invoicing and billing. This may not be a problem for some traders, but it can be a drawback for others who need more control over the look and feel of their invoices and bills.

3. Zoho Books

Pricing Starts at $9/month

The pricing for Zoho Books starts at $9 per month for the Basic plan, which includes features such as invoicing, expenses, bank reconciliation, and project management.

The Standard plan, which starts at $19 per month, includes additional features such as multi-currency support, purchase order creation, and project time tracking. The Professional plan, which starts at $29 per month, includes advanced features such as project billing, custom domains, and custom user roles.

It’s worth noting that Zoho Books offers a free trial for all plans, allowing traders to test the software and determine which plan is right for them before committing to a subscription.

In addition to the monthly subscription, Zoho Books also offers several add-ons and integrations, including payroll, payment gateways, and point-of-sale systems. These add-ons and integrations may incur additional costs.

Best for Businesses with Limited Budgets

Zoho Books is ideal for small businesses and start-ups, particularly those with limited budgets. The software offers a range of features at an affordable price, making it a good choice for traders who are just starting.

Highlights and Hidden Gems of Zoho Books

- Integration with other Zoho applications: Zoho Books is part of the Zoho suite of business applications, and as such, it integrates seamlessly with other Zoho applications, including CRM, payroll, and project management. This integration makes it easy for traders to manage all aspects of their business from a single platform.

- Automated workflows: Zoho Books offers automated workflows that help traders streamline their accounting processes, such as invoicing and expenses. This saves time and reduces the risk of manual errors.

- Project management: Zoho Books includes project management features, such as time tracking and project billing, making it a good choice for traders who need to manage multiple projects and track their expenses.

- Multi-lingual support: Zoho Books is available in multiple languages, including English, Spanish, French, German, and Japanese, making it a good choice for traders who need to communicate with clients and suppliers in multiple languages.

Disadvantages and Limitations of Zoho Books

- Limited budgeting features: Zoho Books does not include advanced budgeting features, such as the ability to create detailed budgets and forecast future cash flow.

- Limited reporting options: Some users have reported that the reporting options in Zoho Books are limited compared to other accounting software, making it difficult to get a clear picture of their finances.

- User interface: Some users have reported that the user interface of Zoho Books can be clunky and not as intuitive as other accounting software. This can make it difficult for traders to navigate and find the information they need quickly and easily.

4. FreshBooks

Pricing Starts at $15/month

FreshBooks is a cloud-based accounting software that offers a range of pricing options to meet the needs of different types of traders. FreshBooks’ Lite plan is priced at $15 per month and is best suited for self-employed individuals and very small businesses. FreshBooks’ Plus plan is priced at $25 per month and is best suited for small businesses with up to 50 clients.

FreshBooks’ Premium plan is priced at $50 per month and is best suited for growing businesses with up to 500 clients. This plan includes everything in the Plus plan, as well as advanced reporting and multi-currency support. FreshBooks’ Select plan is a custom pricing plan that is tailored to meet the needs of larger businesses with more complex accounting requirements.

Best for Streamlining the Accounting Process

FreshBooks is a cloud-based accounting software that is best suited for small businesses and self-employed individuals. Whether you are a freelancer, consultant, or small business owner, FreshBooks can help you stay on top of your finances and streamline your accounting process.

Highlights and Hidden Gems of FreshBooks

- Invoicing with Payment Options: FreshBooks’ invoicing feature allows traders to create and send professional-looking invoices to clients. It can accept online payments, track payment status, and set up recurring invoices.

- Time Tracking: FreshBooks’ time tracking feature allows traders to easily track time spent on projects and bill clients accurately, making it an ideal solution for service-based businesses.

- Expense Tracking: FreshBooks’ expense tracking feature allows traders to easily track expenses, categorize them, and link them to projects for accurate billing and reporting.

- Project Management: FreshBooks’ project management feature allows traders to manage projects, assign tasks to team members, and track progress.

Disadvantages and Limitations of FreshBooks

- Limited Inventory Management: FreshBooks does not have a comprehensive inventory management feature, making it difficult for traders who need to manage large amounts of inventory.

- Limited Reporting Capabilities: FreshBooks’ reporting capabilities are limited compared to other accounting software, making it difficult for traders to get the financial insights they need to make informed decisions.

- Limited Multi-Currency Support: FreshBooks only offers limited multi-currency support, making it difficult for traders who operate in multiple countries or who deal in multiple currencies. This may also result in inaccuracies when converting currencies.

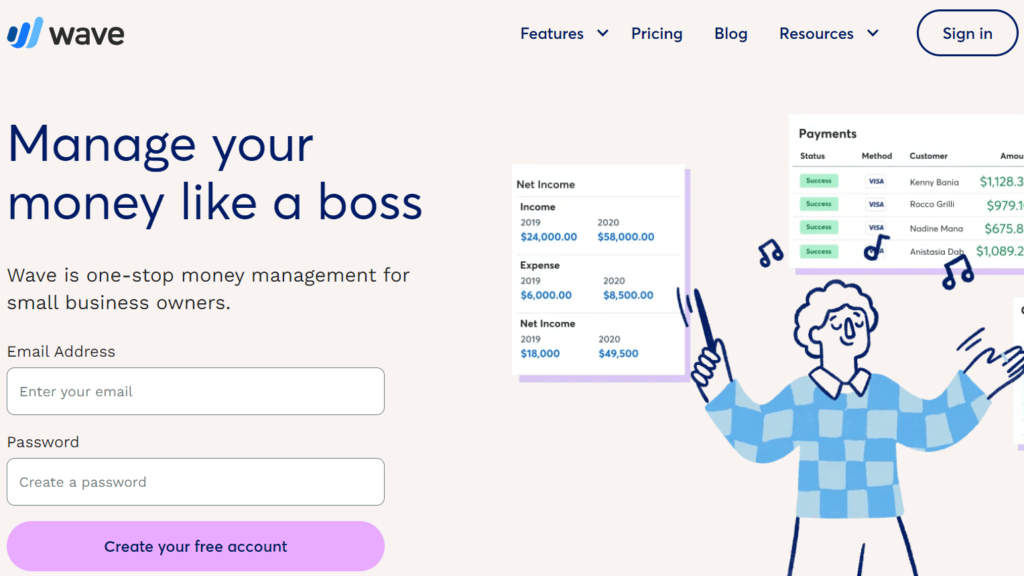

5. Wave

Pricing: Free with a Paid Version

Wave is a free, cloud-based accounting software designed for small businesses and freelancers, including traders. Wave offers a paid version called Wave Plus, which includes additional features such as payroll and payment processing. The pricing for Wave Plus starts at $20 per month.

It’s worth noting that while Wave is free, there are some transaction fees associated with its payment processing services.

Best for Simple & Easy Accounting

Wave is best for small businesses and freelancers, including traders, who are looking for a simple, easy-to-use, and cost-effective accounting solution. It’s ideal for those who don’t have a lot of financial complexity and just need basic invoicing, receipt scanning, and expense tracking capabilities.

Highlights and Hidden Gems of Wave

- Receipt Scanning: Wave’s receipt scanning feature allows traders to easily capture and categorize their expenses, making it easier to keep track of their finances.

- Automated Invoicing: Wave’s invoicing feature is automated, allowing traders to save time by sending invoices with just a few clicks.

- Bank Integrations: Wave integrates with many popular banks, allowing traders to easily import their financial data into the software.

- Invoicing Integrations: Wave integrates with invoicing tools such as FreshBooks, allowing traders to send invoices directly from the software.

Disadvantages and Limitations of Wave

- No Payroll Management: Wave does not offer payroll management, which can be a disadvantage for traders who need to manage their employees’ salaries and benefits.

- Limited Support: Wave’s free version comes with limited support, which can make it difficult to get help if you have questions or need assistance.

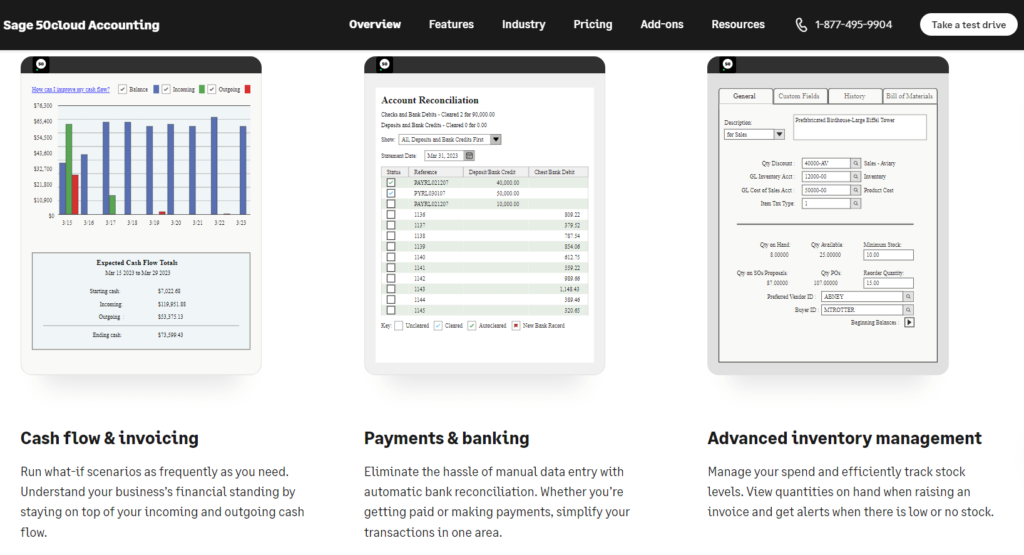

6. Sage 50cloud

Pricing Starts at $40/month

Sage 50cloud is a cloud-based accounting software that is designed for small to medium-sized businesses, including traders. The pricing for Sage 50cloud starts at $40 per month for the Starter edition, $60 per month for the Pro edition, and $80 per month for the Premium edition. The pricing may vary based on the features and functionalities you need, as well as the number of users and companies you need to manage.

Best for Making Informed Financial Decisions

Sage 50cloud is best for small to medium-sized businesses, including traders, who are looking for a comprehensive accounting solution that is easy to use and manage. Whether you’re a new trader or an experienced pro, Sage 50cloud is a great choice for businesses that want to streamline their accounting processes and make informed financial decisions.

Highlights and Hidden Gems of Sage 50cloud

- Real-Time Dashboards: Sage 50cloud provides real-time dashboards, which display real-time data in an easy-to-read format. Traders can use these dashboards to quickly understand their business performance and make informed financial decisions.

- Key Performance Indicators (KPIs): Sage 50cloud provides key performance indicators (KPIs), such as profit margins, return on investment (ROI), and sales growth, to help traders track their performance and identify areas for improvement.

- Financial Statements: Sage 50cloud provides real-time financial statements, including balance sheets, income statements, and cash flow statements, to help traders understand their financial health.

- Project Management: Sage 50cloud includes a project management module that allows traders to track the progress of their projects, manage budgets, and monitor billable hours. This feature can be especially useful for traders who run projects or service-based businesses.

- Cash Flow Analysis. This tool provides real-time insights into a business’s financial health and helps the user to make informed decisions about spending and saving. With Sage 50cloud’s cash flow analysis, users can see a detailed overview of their cash inflow and outflow, view projected cash flow based on outstanding invoices and bills, and compare actual cash flow to projections.

Disadvantages and Limitations of Sage 50cloud

- Complexity: Sage 50cloud is an advanced accounting software and may require a steeper learning curve compared to other options on the market. Some users may find it challenging to navigate and may require additional training.

- Limited Integration Options: While Sage 50cloud integrates with a range of third-party apps and services, the list of available integrations is more limited compared to other accounting software options.

7. Kashoo

Pricing Starts at $15/month

Kashoo is an affordable accounting software solution for traders, with pricing starting at $15 per month for the Self-Employed plan and $20 per month for the Small Business plan. Both plans include unlimited invoicing, expense tracking, and bank connectivity, making it a great option for traders who need to manage their finances in one place. The Small Business plan also includes additional features such as project tracking, time tracking, and multi-currency support, making it ideal for businesses that are expanding globally.

Best for Self-Employed Users Who Need a Simple Solution

Kashoo is best for self-employed traders and small businesses who need a simple yet powerful accounting solution to manage their finances. Kashoo is ideal for traders who want a cost-effective and easy-to-use accounting solution that can help them manage their finances and stay on top of their business operations.

Highlights and Hidden Gems of Kashoo

- Real-time bank connectivity: Kashoo connects to a trader’s bank account, providing up-to-date information on their financial situation.

- Bank reconciliation: Kashoo makes it easy to reconcile your bank statements with your accounting records. You can connect your bank account directly to Kashoo, and the software will automatically import all your transactions. Then, you can easily match your bank transactions with your accounting records, ensuring that your books are up-to-date.

- Custom reports: Kashoo allows you to create custom reports that can help you better understand your business. You can create reports that show your revenue and expenses by category, your cash flow, and your profit and loss statement. You can also export your reports to Excel or PDF, so you can share them with others or save them for future reference.

- Time tracking: The Small Business plan includes time tracking, allowing traders to track their hours and bill their clients accurately.

- Automated reminders: Kashoo can automatically send reminders to clients who have overdue invoices, reducing the need for manual follow-ups.

- Mobile invoicing: Traders can create and send invoices from their mobile devices using the Kashoo mobile app, making it easier to manage their finances while on the go.

Disadvantages and Limitations of Kashoo

- Limited bank integration: Kashoo does not offer as many bank integration options as other accounting software, which can make it difficult for traders to reconcile their accounts and track their cash flow.

- Limited payroll management: Kashoo’s payroll management tools are limited, and traders may need to use separate payroll software for more advanced features.