7 Best Accounting Software For Startups

Starting a new business is an exciting time filled with endless possibilities. But with all the excitement, it’s easy to overlook the importance of having a solid accounting system.

This is where accounting software comes in. With the right tool, you can streamline your finances, stay organized, and save time and money. This post will explore the top accounting software options for startups and help you choose the best solution for your business needs.

Best Accounting Software For Startups

Whether you’re just starting or looking to upgrade your current system, this guide will give you the knowledge you need to make an informed decision. Below are the top 7 accounting software for startups and what makes them best for startups.

- QuickBooks

- Xero

- FreshBooks

- Zoho Books

- Wave

- Kashoo

- Sage 50cloud

1. QuickBooks

Pricing: Starts at $10/month

QuickBooks is a well-known and trusted accounting software that offers a variety of pricing plans to suit different business needs and budgets.

The basic QuickBooks Self-Employed plan is ideal for freelancers and sole proprietors and starts at just $10 per month. This plan includes essential features such as expense tracking, invoicing, and mileage tracking.

The QuickBooks Simple Start plan is an excellent option for startups needing more advanced features. This plan starts at $25 per month and includes income and expense tracking features and the ability to create and send invoices.

For startups with more complex accounting needs, QuickBooks Plus is a great choice. This plan starts at $40 per month and includes multi-user access, detailed reporting, and inventory management.

Best for Startups Looking for a Basic Solution

It’s best for businesses that need a basic yet comprehensive solution for managing their finances.

With QuickBooks, you can easily keep track of your income and expenses, create invoices, and manage your payroll. The software also provides you with financial reports that give you a clear picture of your business’s financial health.

One of the strengths of QuickBooks is its user-friendly interface. The software is designed to be easy to use, even if you don’t have a background in accounting. This makes it an excellent choice for business owners looking for a straightforward solution to managing their finances.

Highlights and Hidden Gems of QuickBooks

- Integrations: QuickBooks integrates with a variety of other tools, such as payment processors, banks, and payroll services, making it a versatile solution for businesses.

- Time tracking: QuickBooks includes a time tracking feature that allows you to easily track billable hours and expenses, making it an excellent choice for service-based businesses.

- Inventory management: QuickBooks Plus includes advanced inventory management features that make it easy to keep track of stock levels, purchase orders, and sales orders.

- Project reporting: QuickBooks allows startups to track expenses for each project, making it easy to manage multiple projects and see how they impact the bottom line.

- Real-time insights: QuickBooks provides real-time visibility into the business’s financial health, helping startups make informed decisions.

Disadvantages and Limitations of QuickBooks

- Limited customization: While QuickBooks provides a range of features, some startups may find that the software does not fully meet their specific needs. Customization options are limited, and businesses may need other solutions for more advanced features.

- Steep learning curve: While QuickBooks is designed to be user-friendly, some startups may still find that the software has a steep learning curve. Business owners and employees may need to invest time in training to get up to speed with the software’s features and functions.

- Limited reporting options: While QuickBooks provides financial reports that give you a clear picture of your business’s financial health, some startups may find that the reporting options are limited.

2. Xero

Pricing: Starts at $9/month

The software has three main pricing plans: Early, Growing, and Established.

The Early plan is designed for solopreneurs and freelancers and offers basic accounting features at an affordable price. The Growing plan is designed for small businesses and includes more advanced features, such as inventory management and multi-currency support. The Established plan is designed for growing businesses and includes all of Xero’s features, including advanced reporting and project management.

Xero also offers add-on services, such as payroll and payment processing, at an additional cost.

Best for Startups Looking For Automation & Collaboration

Xero is a cloud-based accounting software that is best for small businesses and growing companies. The software is designed to provide a comprehensive solution for managing your finances and is particularly well-suited for startups that need automation, precise tracking, and collaboration.

Xero automates many manual accounting tasks, such as bank reconciliation, invoicing, and expense tracking. This saves time for startups and reduces the risk of errors.

Highlights and Hidden Gems of Xero

- Bank reconciliation: Xero automatically reconciles your bank transactions, saving you time and reducing the risk of errors.

- Expense tracking: Xero makes it easy to track your expenses, giving you a clear picture of your cash flow. You can upload receipts and categorize expenses for better tracking.

- Multi-currency support: Xero allows you to manage multiple currencies, making it a great choice for startups that operate in multiple countries or deal with international clients.

- Collaboration: Xero allows multiple users to access the same financial information, making it easy for startups to work together with their teams, advisors, or accountants.

- Advanced reporting: Xero provides a range of reporting options, including cash flow and balance sheets, which can be customized to suit the specific needs of each business.

Disadvantages and Limitations of Xero

- Limited inventory management: Xero’s inventory management capabilities are limited compared to other accounting software, which may be a disadvantage for startups that sell products.

- Reporting limitations: Some users have reported limitations in Xero’s reporting capabilities, especially when customizing reports to meet specific needs.

- Third-party add-ons can be costly: While Xero integrates with many other tools, some integrations can be expensive and may only be necessary for some startups.

3. FreshBooks

Pricing: Starts at $15/month

FreshBooks is a cloud-based accounting software that offers flexible pricing options for startups. FreshBooks has four plans: Lite, Plus, Premium, and Select.

The Lite plan is the most basic and affordable option, starting at $15 per month. This plan is suitable for small businesses and freelancers that need to send invoices and track expenses.

The Plus plan is the next level and starts at $25 per month. This plan offers more advanced features, such as project management and time tracking, making it a good choice for startups that need more comprehensive accounting software.

The Premium plan starts at $50 per month and offers even more advanced features, such as automatic billing and recurring invoices. This plan is best for startups that need robust accounting software that can grow with their business.

The Select plan is FreshBooks’ most advanced and customizable plan. This plan is tailored to the needs of larger businesses and starts at $50 per month.

Best for Startups Looking For Strong Invoicing Capabilities

FreshBooks is best for freelancers and service-based startups that need a user-friendly interface and strong invoicing capabilities. FreshBooks is best for startups because it offers a combination of affordability, ease of use, and powerful features designed to meet growing businesses’ needs.

Highlights and Hidden Gems of FreshBooks

- Automated late payment reminders: FreshBooks can send automated late payment reminders to help you get paid on time. This is a valuable tool for startups that need to manage cash flow effectively.

- Expense tracking: FreshBooks makes it easy to track your expenses, so you can see where your money is going and make informed decisions about your finances.

- Client management: FreshBooks includes features for managing client information, including contact details and project history, helping businesses stay organized and build better relationships with their clients.

- Payment processor integration: FreshBooks integrates with popular payment processors, such as Stripe, PayPal, and Square, to make it easy for businesses to get paid. Also, FreshBooks integrates with banking software such as Bank of America, Capital One, and Chase, making it easy for startups to manage their accounts.

Disadvantages and Limitations of FreshBooks

- Limited inventory management: While FreshBooks provides basic invoicing and expense tracking features, it only offers robust inventory management features. This may be a limitation for startups that need to track stock levels and manage their inventory.

- Limited payroll capabilities: FreshBooks does not have a built-in payroll system, so you’ll need to use a separate service or manually process payroll if your startup has employees.

- Limited budgeting and forecasting features: FreshBooks provides basic financial reporting and analytics but doesn’t have built-in budgeting and forecasting features. This may be a limitation for startups that need more advanced financial planning tools.

4. Zoho Books

Pricing: Starts at $9/month

Zoho Books offers a range of pricing plans to suit different budgets and business sizes, making it a cost-effective solution for startups looking to manage their finances effectively.

Zoho Books pricing for startups typically starts at $9 per month for the basic plan, which includes features such as invoicing, expense tracking, and bank reconciliation.

The standard plan, which includes additional features such as project management and purchase order creation, starts at $19 per month. The professional plan, which includes even more advanced features such as multi-currency support and custom domains for invoices, starts at $29 per month.

Best for Startups Looking for Affordability

Zoho Books is best for startups that need a comprehensive yet affordable accounting solution. Zoho Books makes it easy to create and send invoices, manage customer payments, and track billing information. It’s easy for startup associates to use this software, even without having a background in accounting.

Highlights and Hidden Gems of Zoho Books

- Automated financial reports: Zoho Books generates financial reports automatically, so you can quickly get a snapshot of your business performance and make informed decisions.

- Time tracking: Zoho Books allows you to track your time on different projects and bill your clients accordingly. This can help you understand your project costs better and ensure you’re charging the right amount for your work.

- Sales tax calculations: Zoho Books automatically calculates sales tax based on the location of the business and its clients, helping startups to stay compliant with local tax laws.

- Multi-user access: Zoho Books allows multiple users to access the same financial information, making it easy for startups to work together with their teams, advisors, or accountants.

- Automated payment reminders: Zoho Books includes automatic payment reminders, helping startups get paid faster by reminding clients when their invoices are due.

Disadvantages and Limitations of Zoho Books

- User interface: Some users may find the Zoho Books interface a little cluttered and difficult to navigate, making it challenging to find the information you need quickly.

- Limited payroll features: While Zoho Books does offer some payroll features, such as the ability to pay employees and track salaries, it may need to be more comprehensive for startups with more complex payroll needs.

- Limited budgeting and forecasting: Zoho Books does not have a built-in budgeting and forecasting tool, which may make it difficult for startups to plan their finances effectively.

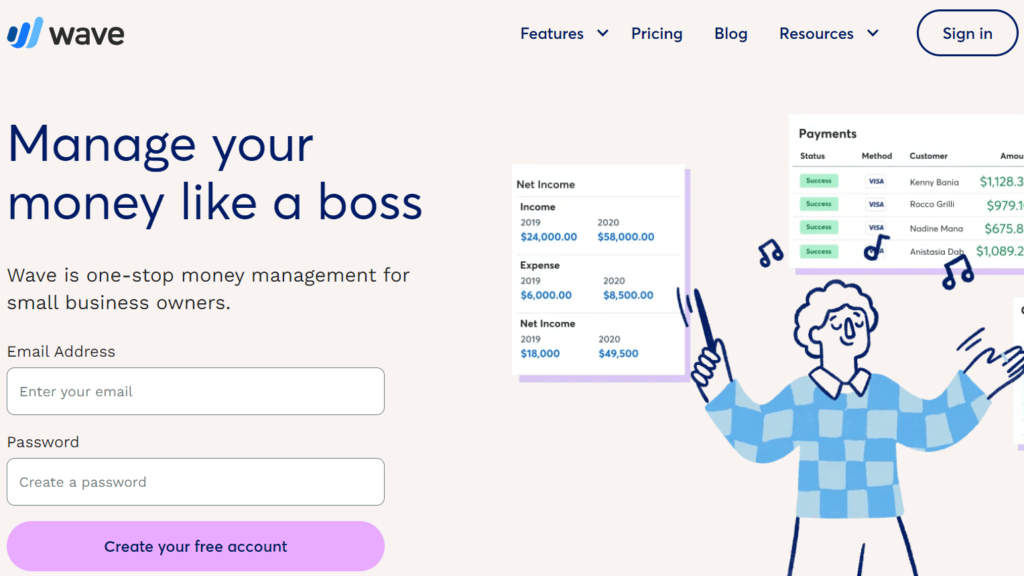

5. Wave

Pricing: Free with Add-on Options

Wave is a free accounting software that is designed specifically for small businesses and startups. It offers a range of features, including invoicing, expense tracking, and financial reporting, all of which are available at no cost. There are no hidden fees or charges, making it a cost-effective option for startups that are just getting started and need to manage their finances on a tight budget.

While Wave is free, it does offer a range of paid add-ons and premium features, such as payroll services, that are available for an additional fee. These premium features can be a good option for startups that need more advanced functionality or need to scale their financial operations as they grow.

Best for Startups Looking for a Free & Basic Solution

Wave is best for businesses that need a free accounting solution with basic features. Wave is free for small businesses, making it a superb option for out-of-the-gate startups that need to manage their finances on a tight budget.

Wave has a clean and straightforward interface that makes it easy to navigate and use, even for those with little or no experience with accounting software.

Highlights and Hidden Gems of Wave

- Free basic features: Wave’s core features, such as invoicing, expense tracking, and financial reporting, are available for free, making it appealing to startups that are just getting started and need to manage their finances on a tight budget.

- Automated bookkeeping: Wave’s automatic bookkeeping feature helps keep track of transactions and categorize them automatically, saving startups time and reducing the risk of manual errors.

- Personal finance management: Wave also offers budgeting and savings tracking features, making it a great all-in-one solution for startups that need to manage their business and personal finances.

- Investment tracking: Wave has a built-in investment tracking feature that allows startups to keep track of their investments and see how they are performing, helping them make informed decisions about their finances.

Disadvantages and Limitations of Wave

- Limited functionality compared to other accounting software: Wave offers only the most basic accounting features, which may not be enough for startups that need more advanced functionality, such as inventory management or project management.

- Limited support options: Wave offers limited support options, including only email support, which can be time-consuming and may not provide an immediate resolution to issues.

- Limited integrations: Wave integrates with only a few other tools, such as payment processors and banks, which can limit its usefulness for startups that need to integrate with other software systems to manage their finances effectively.

6. Kashoo

Pricing: Offers Free Plan

Kashoo is a cloud-based accounting software solution that offers different pricing plans to meet the needs of startups. The pricing plans include the following:

Simple Start: This plan is free and includes basic accounting features, such as invoicing, expense tracking, and financial reporting.

Pro Plan: This plan starts at $19 per month and includes more advanced features, such as multi-currency support, project tracking, and bank reconciliation.

Team Plan: This plan is designed for teams and starts at $29 per month, offering multi-user access and custom reporting features.

Overall, Kashoo offers a range of pricing plans that cater to the needs of startups, starting from free and offering more advanced features for an affordable price. The pricing plans are flexible and allow startups to upgrade or downgrade as their needs change.

Best for Startups Looking for Strong Reporting Functionality

Kashoo is best for startups that need a straightforward accounting solution to manage their finances effectively.

It offers a range of basic accounting features with strong reporting capabilities, including invoicing, expense tracking, and financial reporting, making it an ideal choice for small businesses and startups.

Highlights and Hidden Gems of Kashoo

- Simplicity: Kashoo is designed with small businesses in mind. It has a simple and intuitive interface that makes it easy to manage finances, even for those without an accounting background.

- User-friendly interface: Kashoo has a simple and intuitive interface that is easy to navigate, making it ideal for startups that need a dedicated finance team.

- Automated bookkeeping: Kashoo automates bookkeeping tasks, such as reconciling bank transactions and categorizing expenses, saving startups time and effort.

- Integrations with E-commerce platforms and receipt trackers: Kashoo features several beneficial app integrations that many startups work with on a daily basis. These include e-commerce platforms such as Shopify and WooCommerce and receipt-tracking apps such as Expensify and Shoeboxed.

Disadvantages and Limitations of Kashoo

- Limited features: While Kashoo offers a range of basic accounting features, it does not have as many advanced features as some of its competitors, such as QuickBooks or Xero.

- Limited integrations: Kashoo has limited integrations with other software and services, which may limit its functionality for some startups.

- Limited support: Kashoo’s support options are limited compared to some of its competitors, which may not be ideal for startups that need help quickly.

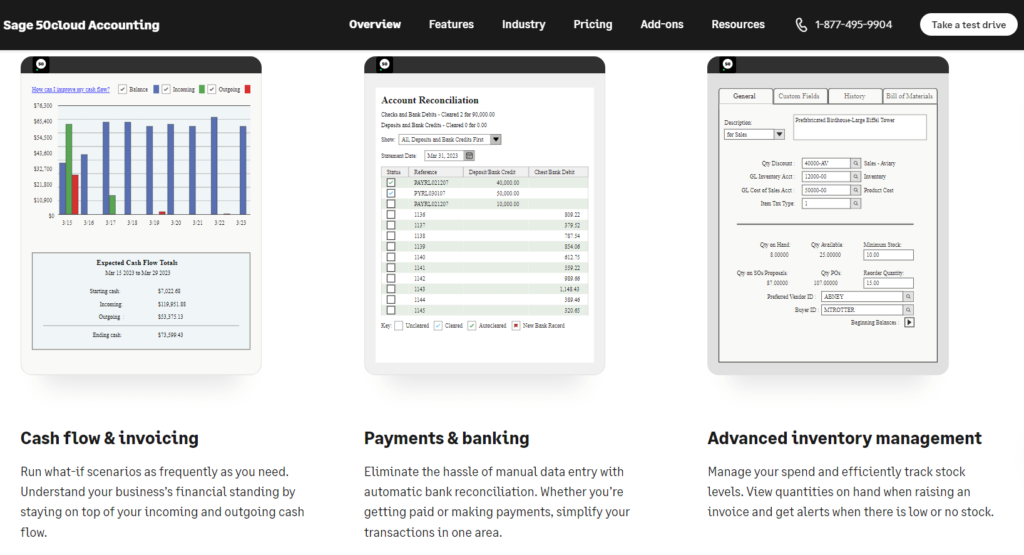

7. Sage 50cloud

Pricing: Starts at $30/month

Sage 50cloud is a cloud-based accounting software designed for small and medium-sized businesses. The pricing for Sage 50cloud starts at $30 per month for the Essential plan and goes up to $70 per month for the Premium plan. These prices are based on an annual subscription and may vary based on the startup’s specific needs.

It’s worth noting that Sage 50cloud offers a free trial period for new users, allowing startups to test the software and see if it’s a good fit for their needs before committing to a paid subscription.

Best for Startups That Need Advanced Features

Sage 50cloud is best for startups that are looking for a robust accounting solution with advanced features and flexibility. This software is designed specifically for small to medium-sized businesses, making it a good fit for startups in a variety of industries.

With Sage 50cloud, businesses can easily upgrade their plan to accommodate changes in their volume and financial reporting needs without switching to different software.

Highlights and Hidden Gems of Sage 50cloud

- Financial Management Tools: Sage 50cloud offers a range of financial management tools, including invoicing, expenses, and advanced reporting. These tools are easy to use and can help startups streamline their financial processes and gain greater visibility into their financial performance.

- Integrations: Sage 50cloud integrates with a variety of other software and services, including payment processors, banks, and payroll systems. This integration can help startups automate key financial tasks and save time, making it easier for them to manage their finances efficiently.

- Payroll Management: Sage 50cloud includes a payroll module, making it easy for businesses to manage employee pay and taxes.

- Bank Reconciliation: Sage 50cloud allows businesses to reconcile their bank statements with their financial records, helping to ensure accuracy and reduce the risk of errors.

Disadvantages and Limitations of Sage 50cloud

- Steep Learning Curve: Sage 50cloud is a robust and feature-rich software, making it difficult for some startups to utilize its capabilities thoroughly. There is a steep learning curve associated with the software, and it may take some time for startups to become proficient in using it.

- Limited Mobile App: While Sage 50cloud is cloud-based, it has a limited mobile app that may not be sufficient for startups that need to access their financial data on the go. This can be an issue for startups with remote employees who need to manage their finances while away from their desks.

- Higher Cost: Sage 50cloud can be more expensive for startups than other accounting software. This cost can be a barrier for some startups, especially those with limited budgets. However, it is worth noting that the advanced features and integrations offered by Sage 50cloud may offset this cost for some businesses.