9 Best Accounting Software for Nonprofits

Nonprofit organizations face a unique set of financial challenges that require specialized accounting software to manage their finances effectively. From tracking donations to managing budgets, nonprofits require a solution that can keep up with their fast-paced operations and changing needs. With so many accounting software options available, choosing the right one for your organization can be overwhelming. That’s why we have put together a comprehensive list of the top 8 accounting software for nonprofits, so you can make an informed decision and find the best solution for your organization’s financial management needs.

Best Accounting Software for Nonprofits

- Aplos

- FreshBooks

- Xero

- Zoho Books

- Realm

- Wave Accounting

- Quicken

- NetSuite

- Sage Intacct

1. Aplos

Pricing Starts at $40/month

Aplos offers its software starting at $40 per month for the nonprofit standard plan. The nonprofit plus plan starts at $60 per month, and the nonprofit premium plan starts at $90 per month. These prices are based on an annual subscription, but Aplos also offers a monthly subscription option. The pricing may vary based on the number of users, the size of your organization, and the features you need.

Best for Small or Mid-Sized Nonprofits

Aplos is best for small to medium-sized nonprofit organizations that need an all-in-one solution for their accounting, fundraising, and donor management needs. Aplos is a great option for nonprofits that want to streamline their financial operations and keep their finances organized.

Highlights and Hidden Gems of Aplos

- Automated donation tracking: Aplos automates the donation tracking process, making it easy for nonprofits to keep track of their contributions and see the impact of their fundraising efforts.

- Budget tracking: Aplos’ budget tracking feature allows nonprofits to set and track budgets, monitor expenses, and keep their finances organized.

- Grant management: Aplos offers a grant management feature, making it easy for nonprofits to manage and track grant applications, funding, and reporting.

- Customizable reporting: Aplos allows nonprofits to customize their financial reports to meet their specific needs, giving them a more in-depth understanding of their financial data.

Disadvantages and Limitations of Aplos

- Limited payroll features: Aplos does not offer robust payroll features, which can be a disadvantage for nonprofits with many employees.

- Limited expense tracking: Aplos does offer basic expense tracking, but it may not be as comprehensive as other accounting software options.

2. FreshBooks

Pricing Starts at $15/month

FreshBooks offers its accounting software starting at $15 per month for the Lite plan. The Plus plan starts at $25 per month, the Premium plan starts at $50 per month, and the Select plan starts at $100 per month. These prices are based on an annual subscription, but FreshBooks also offers a monthly subscription option. The pricing may vary based on the number of users, the size of your organization, and the features you need. It’s recommended to check their website for the most up-to-date pricing information and to get in touch with their sales team for a personalized quote. FreshBooks does not offer a specific pricing plan for nonprofits, but the basic plan is affordable for many small to medium-sized organizations.

Best for Expense Tracking and Financial Decision-Making

With its affordable pricing and comprehensive features, FreshBooks is a great option for nonprofits that want to keep their finances organized and make informed decisions.

Highlights and Hidden Gems of FreshBooks

- Invoicing and payment tracking: FreshBooks offers a range of invoicing and payment tracking features, making it easy for businesses to keep track of their income and expenses.

- Time tracking: FreshBooks’ time tracking feature allows businesses to track the time they spend on projects and tasks, making it easier to manage their finances and stay on top of their work.

- Project management: FreshBooks offers project management features, making it easy for businesses to manage their projects and keep track of their progress.

- Expense tracking: FreshBooks’ expense tracking feature makes it easy for nonprofits to keep track of their expenses, which is essential for staying on budget and ensuring that their finances are under control.

- Integrations: FreshBooks integrates with a range of other tools, including payment gateways, project management software, and payroll services, making it a versatile solution for nonprofits that need a flexible accounting solution.

Disadvantages and Limitations of FreshBooks

- Limited customer support: FreshBooks’ customer support options are limited compared to other accounting software, making it difficult for businesses to get the help they need when needed.

- No multi-currency support: FreshBooks does not offer multi-currency support, making it difficult for businesses operating in multiple countries or dealing with foreign currency.

3. Xero

Pricing Starts at $9/month

Xero offers a range of pricing plans to meet the needs of different-sized businesses, including nonprofits. Xero offers a range of pricing options, including a monthly subscription-based model, with plans starting at $9 per month for their Early plan and $30 per month for their Growing plan. Xero also offers a quote-based pricing model for their Premium plan, which is tailored to the needs of larger businesses and nonprofits. Nonprofits can reach out to Xero for a customized quote based on their specific needs and budget.

Best Flexible Accounting Solution

Xero is best for businesses and nonprofits that need a robust and flexible accounting software solution. Xero offers a range of features that make it an excellent option for businesses of all sizes.

Highlights and Hidden Gems of Xero

- Automated bookkeeping: Xero offers automated bookkeeping, which saves businesses and nonprofits time and reduces the risk of errors, making it easier to manage their finances.

- Budgeting and forecasting: Xero offers budgeting and forecasting features that help businesses and nonprofits plan their finances and make informed decisions.

- Inventory management: Xero offers inventory management features that make it easy for businesses and nonprofits to track their inventory and manage their stock levels.

- Tax reports: Xero offers tax reports, making it easy for users to track their tax liability and ensure they comply with tax regulations.

- Budget comparison: Xero allows users to compare their actual financial performance to their budget, making it easy to identify areas of overspending or underperforming.

Disadvantages and Limitations of Xero

- Limited inventory management: Xero’s inventory management features are limited, which can be a disadvantage for businesses and nonprofits that need advanced inventory management capabilities.

- Limited integrations: Xero has limited integrations compared to other accounting software solutions, which can limit its functionality for businesses and nonprofits that need to integrate with other tools.

4. Zoho Books

Pricing Starts at $9/month

Zoho Books offers several pricing plans for its accounting software for nonprofits.

Basic plan: This plan starts at $9 per month and includes features such as invoicing, expenses, and bank reconciliation.

Standard plan: This plan starts at $19 per month and includes additional features such as project management and inventory management.

Professional plan: This plan starts at $29 per month and includes even more advanced features, such as time tracking and multi-currency support.

Premier plan: This plan starts at $49 per month and offers the full range of features, including advanced reporting and multi-user access.

Best for Nonprofits that Need Scalability

Zoho Books is suitable for nonprofits of all sizes and is designed to be scalable as the organization grows. Zoho Books is best for nonprofits that need an affordable, user-friendly, and comprehensive accounting software solution.

Highlights and Hidden Gems of Zoho Books

- Integration with other Zoho applications: Zoho Books integrates with other Zoho applications, such as Zoho CRM and Zoho Projects, providing nonprofits with a seamless experience and eliminating the need to switch between multiple software solutions.

- Sales Tax Report: This report provides a detailed summary of sales tax collected and paid, helping nonprofits keep track of their sales tax obligations.

- Accurate Time Tracking: Zoho Books allows nonprofits to track time in real time, providing an accurate record of the time spent on specific tasks and projects.

- Project Management: Zoho Books allows nonprofits to track time against specific projects, providing valuable insights into project progress and cost.

Disadvantages and Limitations of Zoho Books

- User interface: Some users have reported that the user interface in Zoho Books can be confusing and difficult to navigate, particularly for those who are new to accounting software.

- Limited customization options: Zoho Books offers limited customization options, which can be a disadvantage for nonprofits that need to tailor the software to their specific needs and requirements.

5. Realm

Pricing: Free Plan Available

Realm pricing varies based on the specific needs and requirements of the nonprofit. Realm offers several different pricing plans, including a free plan as well as paid plans that range from $49 per month to $399 per month.

The free plan offers basic accounting and bookkeeping features, while the paid plans offer more advanced features and support, including integration with other software tools, custom reporting options, and dedicated support.

Best for Religious Nonprofits Looking for a Comprehensive Solution

Realm is best for churches and faith-based nonprofits that need a comprehensive and integrated solution for their accounting, fundraising, and member management needs.

Highlights and Hidden Gems of Realm

- Church Management Tools: Realm offers a suite of tools designed specifically for churches, including tools for member management, communication, and event scheduling.

- Robust Accounting Features: Realm provides a robust accounting system that is designed to meet the unique needs of churches and faith-based nonprofits. This includes features such as automatic bank reconciliation, budget tracking, and general ledger management.

- Fundraising Tools: Realm provides a suite of fundraising tools that are designed to help churches and nonprofits raise money more effectively. This includes tools for online giving, recurring donations, and pledge tracking.

- Donor Management Integrations: Realm is designed to integrate with a variety of other software tools, including payroll systems, point-of-sale systems, and donor management systems, making it easy for organizations to use the tools that are best for them.

Disadvantages and Limitations of Realm

- Complexity: Realm is a comprehensive platform that offers a range of features and tools, which can make it difficult to navigate and understand for some users. This can be especially true for organizations that are new to using accounting software or for those that have limited resources for training and support.

- Technical issues: While Realm is a well-designed and reliable platform, some organizations have reported technical issues with the software. This can include issues with data migration, syncing, and other technical elements of the platform.

6. Wave Accounting

Pricing: Free

Wave Accounting is a free, cloud-based accounting software designed for small businesses and nonprofits. While Wave Accounting does not offer any paid plans or premium services, it does allow users to connect to its network of third-party apps and services, many of which may have fees.

It’s important to note that while Wave Accounting is free, it does not offer the same level of functionality and support as paid accounting software options. However, for organizations with limited budgets or basic accounting needs, Wave Accounting can be a good starting point.

Best for Nonprofits with Limited Budgets

Wave is a superb option for small organizations that need to manage their finances but do not have the resources or expertise to invest in more complex accounting software solutions. Additionally, Wave Accounting can be a good choice for organizations that are just starting and do not yet have a large volume of financial transactions to manage.

Highlights and Hidden Gems of Wave

- Expense tracking: The software allows organizations to track their expenses, categorize them, and generate reports for financial analysis.

- Financial reporting: Wave Accounting provides a range of financial reports, including balance sheets, income statements, and cash flow statements, to help organizations understand the financial health of their business.

- Payment Processor Integrations: Wave Accounting integrates with popular payment processors such as PayPal, Stripe, and Square to allow for easy acceptance of online payments.

- Payroll Provider Integrations: Wave Accounting integrates with popular payroll providers, such as Gusto, ADP, and Paychex, to allow for easy management of employee payroll and tax compliance.

Disadvantages and Limitations of Wave

- Limited features: Compared to other accounting software, Wave Accounting has limited features, which may not be suitable for more complex organizations.

- Limited customer support: As free software, Wave Accounting offers limited customer support, with no telephone support available.

7. Quicken

Pricing Starts at $34.99/month

Quicken provides several pricing options for its accounting software, with prices ranging from $34.99 to $74.99 per year. The cost varies depending on the features and level of support provided. Some advanced features, such as investment tracking and budgeting, may only be available in the higher-priced options. However, those interested in trying out Quicken’s software can take advantage of the free trial offered by the company before making a purchase.

Best for Volunteer-Run Nonprofits

Quicken is best for personal finance management, specifically for individuals and small business owners who are looking to manage their finances in one place. Quicken allows users to track their spending, manage their budget, and see all their financial accounts in one place.

Highlights and Hidden Gems of Quicken

- Budgeting and Money Management: Quicken allows users to create a budget and track their spending, making it easier to see where their money is going and identify areas where they can save.

- Investment Tracking: Quicken provides a comprehensive investment tracking system, allowing users to see all their investments in one place and track their performance.

- Bill Management: Quicken makes it easy to manage bills by providing a centralized location to see all bills due and track payments.

- Investment Planning: Quicken also provides investment planning tools, allowing users to see the impact of their investments on their financial goals and plan for the future.

Disadvantages and Limitations of Quicken

- Limited Nonprofit Accounting Features: Quicken is designed primarily for personal finance management, so it may not have all the features and tools that a nonprofit organization would need. For example, it may not have features like grant tracking or fundraising management.

- Complexity: Quicken can be complex for users who are not familiar with accounting software, especially for those who have never managed finances before.

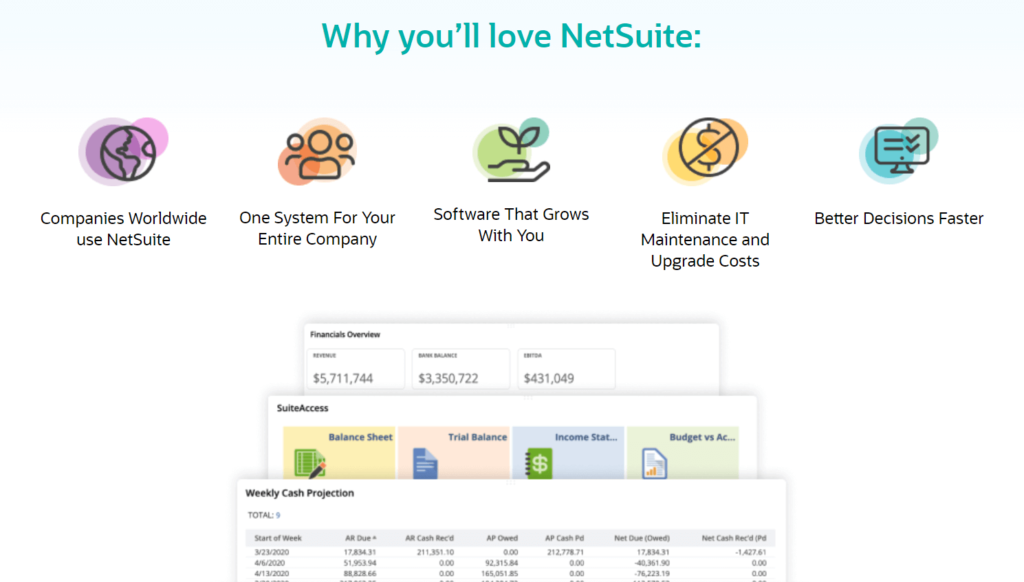

8. NetSuite

Pricing: Customized to Client

Netsuite pricing for nonprofits can vary depending on the specific needs and requirements of the organization. Their full pricing isn’t listed publicly. Typically, Netsuite offers various pricing options based on the number of users, features required, and the level of customization needed. For example, Netsuite offers a basic package starting at $999 per month, which includes core financials, accounting, and HR management. However, for more complex nonprofit organizations, the cost can be much higher.

Best for Businesses that Need a Fully Customizable Accounting Solution

Netsuite is best for larger nonprofit organizations that need a comprehensive and customizable accounting and financial management solution.

Highlights and Hidden Gems of Netsuite

- Grant Management: Netsuite offers a grant management module that allows nonprofits to manage all aspects of the grant application and award process, including grant tracking, reporting, and compliance.

- Donor Management: Netsuite provides a donor management module that allows nonprofits to manage all aspects of their donor relationships, including donor tracking, donation processing, and donation reporting.

- Financial Management: Netsuite offers a range of financial management features, including financial reporting, budgeting, and accounting, which are designed to meet the unique needs of nonprofit organizations.

- Suite Pro Bono: NetSuite provides free software licenses and professional services to qualifying nonprofit organizations through this program. This can help smaller nonprofits access enterprise-level software and services that might otherwise be out of their reach.

Disadvantages and Limitations of Netsuite

- High Cost: Netsuite is a more expensive option than other accounting software solutions for nonprofits. The cost can be a barrier for smaller organizations.

- Complexity: Netsuite is a complex software solution that requires significant time and resources to implement and manage effectively. This complexity can be a challenge for organizations with limited resources or IT staff.

- Learning Curve: Netsuite has a steep learning curve, making it difficult for users to become proficient with the software quickly. This can be a challenge for organizations with limited training and support resources.

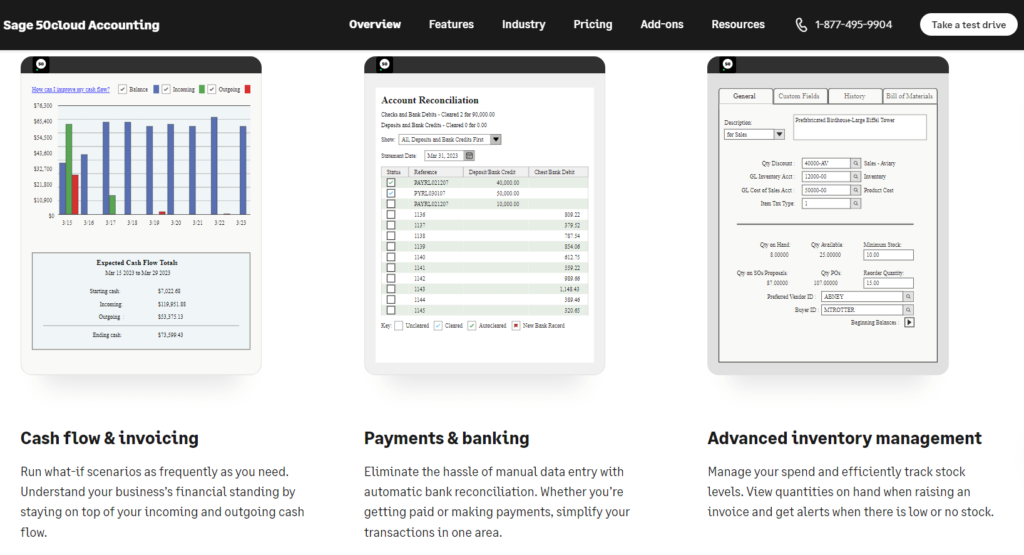

9. Sage Intacct

Pricing: Based on Organization Size and Features

Sage Intacct offers various pricing plans for its accounting software, with pricing options based on the size of the organization and the features needed. The pricing can range from $400 to $1,000 per month for the basic plan and can go up to $5,000 to $10,000 per month for the more advanced plans. It is recommended to contact Sage Intacct directly for a more accurate quote based on the specific needs of the organization.

Best for Tailored Accounting Software

Sage Intacct is best for nonprofits that are looking for a highly advanced and flexible accounting solution with robust financial management and reporting capabilities. It is particularly well-suited for large and complex organizations with a high volume of transactions, who require a high level of automation and integration with other systems. Sage Intacct’s cloud-based platform also provides the scalability and security that organizations need to grow and manage their finances effectively.

Highlights and Hidden Gems of Sage Intacct

- Advanced Financial Management: Sage Intacct provides robust financial management tools that automate many of the manual tasks associated with accounting. This includes features such as multi-currency support, real-time financial reporting, and advanced budgeting and forecasting tools.

- Grant Management Tool: Sage Intacct has a powerful grant management tool that helps organizations keep track of grant reporting requirements.

- Fundraising Integrations: Sage Intacct integrates with a variety of other systems, including payment processors, payroll providers, and fundraising systems. This makes it easy for nonprofits to streamline their operations and improve their overall efficiency.

- Centralized Project Management: Centralized project management in Sage Intacct refers to the ability to manage all aspects of a project in one central location. This feature allows nonprofits to track project expenses, revenue, and progress in real time and provides a clear view of the project’s financial health. The centralized project management tool is an easy-to-use platform that helps organizations stay on top of their project budgets and resources, ensuring that the project stays on track and within budget.

Disadvantages and Limitations of Sage Intacct

- Complex Data Migration: Some users have reported difficulties in migrating data from other accounting software to Sage Intacct, which can be a major issue for nonprofits that are switching from another platform.

- Slow Customer Support: Some users have reported slow response times from the customer support team, which can be a significant issue for nonprofits that need a quick resolution of accounting issues.