8 Best E-commerce Accounting Software

E-commerce has revolutionized how people shop. It makes it easier for businesses to sell their products and services online. However, with the rise of e-commerce, there comes a need for efficient accounting and bookkeeping processes to keep track of finances. Fortunately, several accounting software options are available specifically designed for e-commerce businesses. In this article, we will explore the eight best e-commerce accounting software options, features, and pricing to help you choose the best one for your business.

Best E-commerce Accounting Software

- Zoho Books

- Freshbooks

- Sage 50cloud

- Taxjar

- Wave

- Xero

- ZipBooks

- FreeAgent

1. Zoho Books

Pricing Starts at $9/month

Zoho Books offers three pricing plans: Basic, Standard, and Professional. The Basic plan costs $9 per monthly organization and includes 50 contacts and two users. The Standard plan costs $19 per organization monthly and includes 500 contacts and three users. The Professional plan costs $29 per organization month and includes unlimited contacts and ten users.

Best for SMBs that Need Extensive Integrations

Zoho Books is best for small to mid-sized e-commerce businesses that need comprehensive and easy-to-use accounting software with extensive integrations.

Highlights and Hidden Gems of Zoho Books

- Automated bank feeds and payment reminders: Zoho Books automatically imports transactions from bank accounts and credit cards, making bookkeeping a breeze. Payment reminders help to ensure that invoices are paid on time.

- Invoicing and payment processing: Zoho Books allows users to customize and send invoices and receive payments online. Customers can also make partial payments and payment plans.

- Comprehensive inventory management: Zoho Books offers a complete inventory management system that allows users to track inventory levels, set reorder points, and manage purchase orders.

- Project management: Zoho Books also includes a project management feature that allows users to create and manage projects, track time, and create project-specific invoices.

- Extensive integrations: Zoho Books integrates with over 50 popular apps, including PayPal, Stripe, Shopify, and Amazon, making it easy to automate workflows and save time.

- Bank feeds integration: Zoho Books integrates with over 200 banks and financial institutions, enabling you to import your bank transactions into your accounting software.

- Sales orders: With Zoho Books, you can easily create and manage sales orders, which can help you track inventory levels and ensure that you have the products on hand to fulfill customer orders.

Disadvantages and Limitations of Zoho Books

- Limited customer support: Zoho Books’ customer support is primarily online-based, which may not be sufficient for businesses that need more personalized help.

- Limited customization options: While Zoho Books has a range of features, it may not offer as many customization options as some other accounting software, which may be a drawback for some users.

2. Freshbooks

Pricing Starts at $15/month

Freshbooks offers multiple pricing plans, starting from $15 per month for the Lite plans up to $50 per month for the Premium plan.

Best for Shopify Users

Freshbooks is best for small businesses and freelancers who need user-friendly, cloud-based accounting software that is easy to use and helps them manage their invoicing, time tracking, and expense management. It offers a range of features that are particularly suited to e-commerce businesses, including integrations with popular e-commerce platforms, such as Shopify.

Highlights and Hidden Gems of Freshbooks

- Time Tracking: Freshbooks allows you to track your billable hours and automatically generate invoices based on the time tracked.

- Expenses: With Freshbooks, you can easily track your business expenses, upload receipts, and categorize your expenses for tax purposes.

- Project Management: Freshbooks includes a project management tool that allows you to collaborate with your team, track project progress, and generate reports.

- Automated late payment reminders: Freshbooks has a feature that allows you to automate late payment reminders, which can help you get paid faster and improve your cash flow.

- Multicurrency support: If you sell products or services to customers in different countries, Freshbooks supports multiple currencies, making it easy to invoice and get paid in the currency of your choice.

- Client Retainer feature: Freshbooks allows you to set up client retainers, which allows you to bill a set amount each month or project and automatically generate invoices for the agreed-upon amount.

- Automatic Expense Importing: Freshbooks lets you connect your bank accounts and credit cards and automatically import expenses. This makes it easy to keep track of your spending, categorize expenses, and prepare for tax season.

- Late Payment Reminders: Freshbooks has a feature that automatically sends late payment reminders to your clients, helping you get paid faster and reducing the need for awkward follow-up emails.

Disadvantages and Limitations of Freshbooks

- Limited Reporting: Freshbooks’ reporting features are less robust than some accounting software, with only basic reports available.

- Limited Integrations: Freshbooks has limited integrations with third-party apps and services, which can be a drawback for some businesses with more complex needs.

- Limited Customization: While Freshbooks’ interface is user-friendly, limited software customization options exist to fit specific business needs.

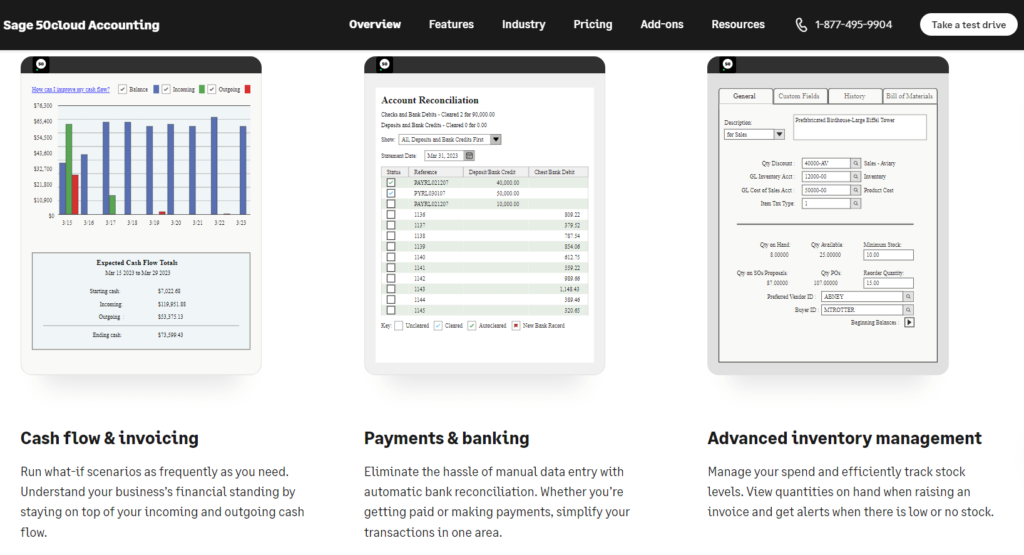

3. Sage 50cloud

Pricing Starts at $50.58/month

Sage 50cloud has three pricing plans – Pro Accounting, Premium Accounting, and Quantum Accounting. Pro Accounting costs $50.58/month, Premium Accounting costs $78.21/month, and Quantum Accounting costs $167.17/month. Each plan comes with different features and capabilities to cater to different business needs.

Best Comprehensive Features

Sage 50cloud is best suited for small and medium-sized businesses that require comprehensive accounting features, such as inventory management, job costing, and project management.

Highlights and Hidden Gems of Sage 50cloud

- Inventory Management: Robust inventory management capabilities that allow users to easily track and manage stock levels, set reorder points, and create purchase orders

- Job Costing: Powerful job costing and project management features that enable businesses to track and manage projects from start to finish

- Create job estimates: Create detailed estimates for each job that include the projected labor cost, materials, and other expenses.

- Track actual costs: As expenses are incurred, users can easily track and allocate them to specific jobs, including labor costs, material costs, and other expenses such as subcontractor fees.

- Advanced Reporting: Advanced reporting tools that provide real-time insights into the financial health of the business, with customizable reports and dashboards

- Integration with Microsoft Office 365: This allows users to access and manage their accounting data from anywhere, on any device.

- Data Backup: Automatic data backup and recovery, providing peace of mind and protection against data loss

- Automated bank feeds: Sage 50cloud offers automatic bank feeds that can be linked with the user’s bank account to import and categorize transactions.

- Payment Processing: Sage 50cloud integrates with payment processors to allow businesses to accept credit card payments, which is essential for e-commerce businesses. It also enables enterprises to track payment information and manage customer accounts.

Disadvantages and Limitations of Sage 50cloud

- Limited scalability: The software is primarily designed for small and medium-sized businesses.

- Overwhelming Interface: The interface can be overwhelming for new users, and some features may require additional training or support to fully understand and utilize.

- Limited Third-Party Integrations: Integration with third-party apps can be limited, with fewer options than other accounting software on the market.

4. Taxjar

Pricing Starts at $19/month

TaxJar has a range of pricing plans starting at $19 per month for their basic plan and going up to $99 per month for their premium plan. They also offer a 30-day free trial for new users.

Best for Sales Tax Assistance

TaxJar is best for online sellers who need help with calculating, collecting, and filing sales tax. It’s especially helpful for businesses with sales in multiple states, as TaxJar automatically calculates the correct sales tax rates for each jurisdiction and can even file sales tax returns for you.

Highlights and Hidden Gems of Taxjar

- Automated Sales Tax Calculation: TaxJar automatically calculates the correct sales tax rates for each jurisdiction and integrates with popular e-commerce platforms like Shopify, Amazon, and eBay.

- Filing Assistance: TaxJar can file your sales tax returns for you in many states, saving you time and hassle.

- Reporting: TaxJar provides detailed reports and insights into your sales tax data, including state-by-state sales and tax liability breakdowns.

- SmartCalcs API: TaxJar’s SmartCalcs API allows developers to build sales tax functionality directly into their applications.

- Detailed tax reports: Taxjar provides detailed tax reports that give e-commerce businesses an overview of their tax liabilities, making it easy to file tax returns and remit tax payments to the relevant authorities.

- Multi-channel support: Taxjar supports multiple sales channels, including marketplaces like Amazon, eBay, and Etsy, and shopping carts like Shopify, Magento, and WooCommerce. This allows e-commerce businesses to consolidate their tax data from multiple sources and get a comprehensive view of their sales tax obligations.

- Product-level taxability: Taxjar’s SmartCalcs API provides product-level taxability information, allowing e-commerce businesses to see which products are taxable and which are exempt. This information is critical in ensuring accurate tax calculations and avoiding overpaying taxes.

- Address validation: Taxjar validates customer addresses, ensuring accurate tax calculations and reducing the risk of incorrect tax collection or remittance.

Disadvantages and Limitations of Taxjar

- Price: TaxJar can be more expensive than some competitors, especially for businesses with high sales volumes.

- State Coverage: While TaxJar supports a large number of states, it doesn’t cover every jurisdiction, so it’s important to check if your state is supported before signing up.

- Limited Integrations: While TaxJar integrates with popular e-commerce platforms, it may not integrate with all of the apps and tools you use to run your business.

5. Wave

Pricing: Free

Wave offers a free accounting software option for small businesses with basic features and an affordable option for small to medium-sized businesses with more advanced needs. They make their money by charging for additional services like payroll and credit card processing.

Best for Budget-Conscious Businesses

Wave is best for small businesses with basic accounting needs who want affordable and easy-to-use accounting software.

Highlights and Hidden Gems of Wave

- Invoicing: Wave offers a free invoicing feature, allowing you to create and send professional invoices to your customers.

- Receipt Scanning: Wave offers a receipt scanning feature that lets you take a picture of your receipts and upload them to the software. This saves time and helps you keep track of your expenses.

- Bank Integration: Wave integrates with many banks, credit cards, and other financial institutions to streamline bookkeeping. This makes it easy to keep track of your transactions and reconcile your accounts.

- Automatic Transaction Syncing: Wave automatically syncs your bank and credit card transactions to reduce manual data entry, saving you time and reducing the risk of errors.

- Sales tax management: Wave offers tools to help you manage sales tax for your e-commerce business, including automatic tax calculation and the ability to track tax exemptions.

- Payment processing: Wave allows you to accept credit card payments online, which can be a significant convenience for your customers. The fees are competitive, and you can set up recurring payments for subscriptions or other recurring charges.

- Inventory tracking: While Wave does not have a dedicated inventory management feature, you can track inventory by creating products or services and assigning quantities to them.

Disadvantages and Limitations of Wave

- Fewer Features: Limited features compared to other accounting software make it less suitable for larger businesses with more complex needs.

- Slow Support: Some users have reported that customer service can be slow to respond

- No Time-Tracking: There is no time-tracking feature, which could be a disadvantage for service-based businesses that need to track employee hours.

6. Xero

Pricing Starts at $11/month

Xero offers three pricing plans, including the Early plan ($11 per month), The Growing plan ($32 per month), and the Established plan ($62 per month). Each plan has a different set of features, with the Early plan being the most basic and the Established plan being the most advanced. Xero also offers a 30-day free trial, allowing users to test out the software before committing to a paid plan. Additionally, Xero offers a variety of add-on features for an additional cost, such as payroll management, project management, and inventory management.

Best for Sellers on Multiple Channels

Xero is best for small to medium-sized e-commerce businesses that are looking for affordable and user-friendly accounting software. It is especially helpful for e-commerce businesses that sell on multiple sales channels and need to manage inventory and cash flow across all of them.

Highlights and Hidden Gems of Xero

- Seamless Integration: Xero seamlessly integrates with over 800 third-party e-commerce applications, making connecting with other business tools easier.

- Inventory Tracking: Xero allows e-commerce businesses to track inventory levels in real time, so they always know what products they have in stock.

- Multi-Currency Support: Xero supports multiple currencies, making it easier for businesses to sell and manage payments in different countries.

- Payment Gateway Integration: Xero integrates with multiple payment gateways, including Stripe, PayPal, and Square, allowing businesses to manage payments easily.

- Automated Invoicing: Xero allows businesses to automate their invoicing process, helping them save time and increase efficiency.

- Budgeting and Forecasting: Xero provides powerful budgeting and forecasting tools that allow businesses to plan and manage their finances effectively.

Disadvantages and Limitations of Xero

- Customer support: Some users have reported difficulties with Xero’s customer support, particularly in resolving issues quickly and efficiently.

- Limited reports: While Xero does offer many standard reports, some users have found that the software cannot customize reports to meet their specific needs.

- Limited functionality: While Xero is an excellent option for small and medium-sized businesses, it may not have all the functionality required for larger or more complex businesses.

7. ZipBooks

Pricing: Free Plan Available

ZipBooks offers a free plan with basic features and a paid plan with more advanced features, starting at $15 per month. There is also a custom pricing plan available for larger businesses with specific needs.

Best Simple, Easy Accounting Solution for Small Businesses

ZipBooks is best suited for small businesses, freelancers, and self-employed individuals who need a simple, easy-to-use accounting solution. It can also be a good option for startups and growing businesses that need affordable accounting software with features like invoicing, project management, and time tracking. The software is designed to be user-friendly and accessible for non-accountants, making it a great choice for businesses with limited accounting experience or resources.

Highlights and Hidden Gems of ZipBooks

- Online Payments: ZipBooks allows businesses to accept online payments from clients directly through the platform, making it easy to get paid quickly and securely.

- Automatic data import: With ZipBooks, e-commerce businesses can easily import data from popular e-commerce platforms like Shopify, Amazon, and Etsy, which can save time and reduce errors.

- Automated invoicing: ZipBooks allows e-commerce businesses to create professional-looking invoices, set up recurring invoices, and automate payment reminders, which can help to improve cash flow.

- Inventory management: ZipBooks offers robust inventory management features that allow e-commerce businesses to track their inventory levels in real-time, set reorder points, and get alerts when inventory levels run low.

- Third-party integrations: ZipBooks offers integrations with popular e-commerce platforms and marketplaces, as well as other business tools like Stripe, PayPal, and Slack.

- Time Tracking: ZipBooks offers a built-in time tracking feature that allows businesses to track employee and billable hours for clients.

- Project Management: The platform allows businesses to create and manage projects, assign tasks to team members, and track project progress.

- Collaboration: ZipBooks offers a feature allowing team members and clients to communicate and collaborate on projects.

Disadvantages and Limitations of ZipBooks

- Limited features: While ZipBooks offers many great features, it may not have all of the features that larger, more complex businesses need. For example, some businesses may require more robust inventory management capabilities or more advanced project management tools.

- Mobile app limitations: While ZipBooks offers a mobile app, it may not be as robust as other accounting software options. Some users have reported issues with the app, including slow loading times and limited functionality.

8. FreeAgent

Pricing Starts at £12/month

FreeAgent pricing is based on a monthly or annual subscription plan. The monthly plan costs £12 per month, while the annual plan costs £120 per year, offering a 20% discount compared to the monthly subscription. FreeAgent offers a 30-day free trial to new users.

Best for Service-Based Businesses

FreeAgent is best for small businesses, freelancers, and contractors who need a cloud-based accounting software solution to help them manage their finances. It is especially useful for service-based businesses, such as marketing agencies, consulting firms, and other professional services. The software offers a range of features designed to simplify bookkeeping, invoicing, and expenses, as well as tax preparation and other financial tasks.

Highlights and Hidden Gems of FreeAgent

- Automatic Bank Feeds: FreeAgent offers automatic bank feeds, which can be linked to your business bank account. This can save time and reduce errors by automatically importing bank transactions into the software.

- Multi-Currency Invoicing: FreeAgent supports invoicing in multiple currencies. This can be useful for businesses that have international clients or suppliers.

- Customizable Dashboard: FreeAgent has a dashboard that allows users to see a snapshot of their finances at a glance. Users can choose which widgets to display on the dashboard, such as bank balances, upcoming invoices, and expenses.

- Project Management: FreeAgent includes a project management feature that allows businesses to track time and expenses for specific projects. This can be useful for businesses that work on multiple projects simultaneously.

- Integration with Other Apps: FreeAgent integrates with a range of other apps, such as PayPal, Stripe, and G Suite. This can help businesses to streamline their workflows and reduce manual data entry.

- Tax Timeline: FreeAgent’s tax timeline feature shows essential tax deadlines and reminders. This can help businesses to stay on top of their tax obligations and avoid penalties.

Disadvantages and Limitations of FreeAgent

- Limited integration options: FreeAgent offers fewer integrations than other accounting software, which may limit its usability for some businesses.

- No inventory management: FreeAgent doesn’t have an inventory management feature, so it may not be suitable for businesses that sell products and need to track their inventory.

- No payroll feature: FreeAgent doesn’t offer a built-in payroll feature, which may be a drawback for businesses that need to manage employee payroll.