9 Best Cheap Accounting Software

Money management is one of the most important aspects of running a successful business. But for small business owners, it can be challenging to find affordable and reliable accounting software. That’s where we come in. In this article, we’ve rounded up the nine best cheap accounting software options for small businesses. From automation features to customizable dashboards, these options offer a range of features at an affordable price. Let’s dive in!

Best Cheap Accounting Software

- FreshBooks

- QuickBooks Online

- Sage Business Cloud Accounting

- A2X

- Payment Rails

- Zoho Books

- Zoho Expense

- ProfitBooks

- Xero

1. FreshBooks

Pricing Starts at $15/month (Lite Plan)

Their pricing plans start at $15 per month for the Lite plan, which includes basic features like invoicing and expense tracking, and go up to $50 per month for the Premium plan, which includes advanced features like team time tracking and project management. FreshBooks also offers a 30-day free trial for new users to test out the software before committing to a paid plan.

Best for Simplicity

FreshBooks is best for small businesses that are service-based and require a simple and easy-to-use accounting solution. The software is designed for freelancers, contractors, and small business owners who need to manage their finances on a day-to-day basis.

Highlights and Hidden Gems of FreshBooks

- Time tracking: FreshBooks offers a user-friendly time tracking feature, allowing users to track time spent on tasks and projects. This can help businesses accurately bill clients and improve their project management.

- Project management: FreshBooks offers project management tools that allow users to track project progress and collaborate with team members. The software also offers time tracking and invoicing features, making it easy to manage all aspects of a project in one platform.

- Payment Processing: FreshBooks offers integrations with several payment processors, including Stripe, PayPal, and WePay, allowing businesses to choose the processor that best fits their needs. The software also offers automatic payment reminders, allowing businesses to set up customized reminder messages for customers when payments are due or overdue.

Disadvantages and Limitations of FreshBooks

- Limited Accounting Features: FreshBooks is primarily designed for invoicing, time tracking, and project management, and as such, it lacks some of the more advanced accounting features that other software options offer.

- Limited Customization: While FreshBooks offers customizable invoice templates, the software does not offer many customization options beyond that.

2. QuickBooks Online

Pricing Starts at $25/month (Simple Start Plan)

Their pricing plans start at $25 per month for the Simple Start plan, which includes basic features like invoicing and expense tracking, and go up to $150 per month for the Advanced plan, which includes advanced reporting and business analytics features. QuickBooks Online also offers a 30-day free trial for new users to test out the software before committing to a paid plan.

Best for Businesses that Require Industry-Specific Features

QuickBooks Online is best suited for small and medium-sized businesses that require a comprehensive accounting solution. It is particularly useful for businesses that have complex accounting needs or require industry-specific features, such as those in the construction or manufacturing industries. The software is also customizable, allowing businesses to tailor it to their specific needs.

Highlights and Hidden Gems of QuickBooks Online

- Customizable dashboard: QuickBooks Online offers a customizable dashboard feature, allowing businesses to view and analyze their financial data in a way that suits their needs. Users can add and remove widgets, charts, and graphs to create a personalized dashboard highlighting the metrics that matter most to them.

- Mileage tracking: QuickBooks Online offers a mileage tracking feature that allows businesses to track and deduct mileage expenses for tax purposes. The software uses GPS technology to automatically track mileage for business trips and allows users to customize and categorize their trips for accurate tracking.

- Budgeting and forecasting: QuickBooks Online offers budgeting and forecasting tools that allow businesses to create and manage budgets and forecast future cash flow. Users can compare actual results to their budget and make adjustments as needed.

- Receipt capture and organization: QuickBooks Online offers a mobile app allowing users to capture and organize receipts for easy tracking and expense reporting. The app uses OCR technology to capture key data from receipts, and users can attach receipts to transactions for accurate record-keeping.

Disadvantages and Limitations of QuickBooks Online

- Limited users: QuickBooks Online’s pricing plans are structured around the number of users, and some plans have a limit on the number of users that can access the software. This can be a limitation for businesses that require multiple users to access the software.

- Learning curve: While QuickBooks Online is user-friendly, it still requires some accounting knowledge and expertise to set up and use.

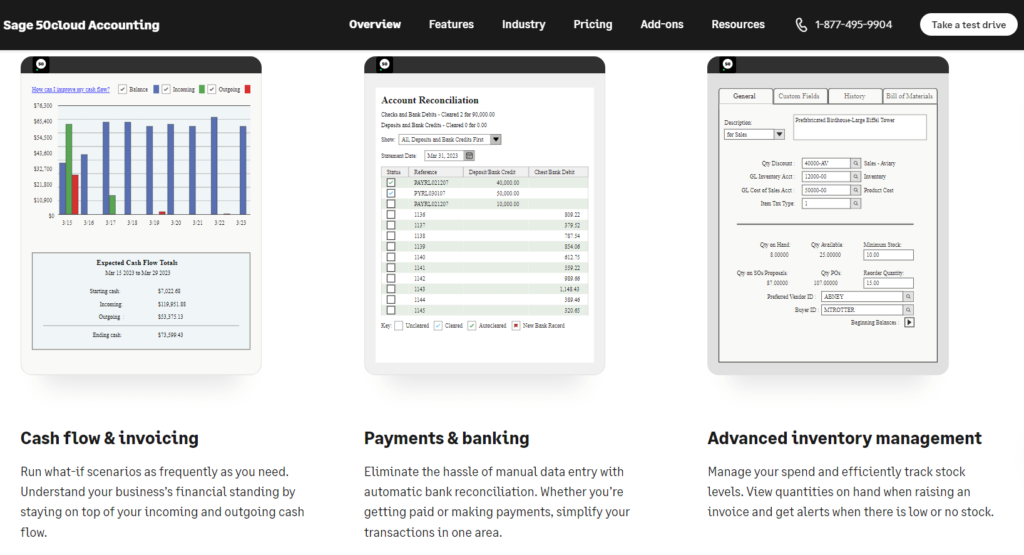

3. Sage Business Cloud Accounting

Pricing Starts at $10/month (Start Plan)

Their pricing plans start at $10 per month for the Start plan, which includes basic features like invoicing and expense tracking, and go up to $25 per month for the Accounting plan, which includes advanced features like inventory management and project costing. Sage Business Cloud Accounting also offers a 30-day free trial for new users to test out the software before committing to a paid plan.

Best for Retail, Wholesale, and Manufacturing Industries

The software is particularly useful for businesses in the retail, wholesale, manufacturing, and construction industries, as these businesses typically require more robust inventory management and project costing features.

Highlights and Hidden Gems of Sage Business Cloud Accounting

- Inventory management: Sage Business Cloud Accounting offers advanced inventory management features, allowing businesses to track their inventory levels and movements in real-time. The software includes features like stock adjustments, transfers, and valuation, making it easier for businesses to manage inventory and control costs.

- Project costing: Sage Business Cloud Accounting offers project costing features that allow businesses to track project costs and profitability in real-time. This can help businesses stay on top of project budgets and make informed decisions about pricing and profitability.

- Bank feeds and reconciliation: Sage Business Cloud Accounting offers bank feeds and automatic bank reconciliation features, allowing businesses to keep their financial records up-to-date and accurate.

Disadvantages and Limitations of Sage Business Cloud Accounting

- Limited reporting capabilities: While Sage Business Cloud Accounting offers a range of financial reports, some users may find that the software’s reporting capabilities are limited compared to other accounting software options on the market.

- Learning curve: Sage Business Cloud Accounting, like most accounting software, requires some accounting knowledge and expertise to set up and use.

4. A2X

Pricing Starts at $19/month (Starter Plan)

A2X offers a range of pricing plans to meet the needs of businesses of all sizes, starting at $19 per month for the Starter plan, which allows for up to 100 Amazon transactions per month. A2X also offers a Professional plan for $149 per month, which includes unlimited transactions and additional features like account mapping and cost of goods sold (COGS) tracking.

Best for E-Commerce Businesses

A2X is best suited for businesses that sell on e-commerce platforms like Amazon and Shopify. The software is particularly useful for businesses that require automated accounting solutions.

Highlights and Hidden Gems of A2X

- Automated accounting: A2X offers automated accounting solutions that allow businesses to reconcile their e-commerce transactions and financial data easily. The software automatically imports transaction data from e-commerce platforms and categorizes them into the appropriate accounts in QuickBooks or Xero.

- Cost of goods sold (COGS) tracking: A2X offers advanced COGS tracking features, allowing businesses to track their product costs and profitability accurately. The software can calculate the cost of goods sold for each product and transaction, making it easier for businesses to track their expenses and revenue.

- Multi-channel support: A2X offers multi-channel support, allowing businesses to easily reconcile their financial data from multiple e-commerce platforms. The software supports a range of platforms, including Amazon, Shopify, Walmart, and Etsy, making it a great choice for businesses that sell on multiple channels.

Disadvantages and Limitations of A2X

- Limited integrations: While A2X offers integrations with popular accounting software like QuickBooks and Xero, it does not offer integrations with other types of software that businesses may require, such as inventory management or project management tools.

- Learning curve: While A2X is user-friendly, it still requires some accounting knowledge and expertise to set up and use. This may be a disadvantage for businesses that do not have a dedicated accounting team or personnel.

5. Payment Rails

Pricing: Pay-As-You-Go Plan Charges $1/transaction

Their pricing plans start at $1 per transaction for the Pay-As-You-Go plan, which is best suited for businesses that send a small number of payments per month. For businesses that require more frequent payments, Payment Rails offers monthly subscription plans that start at $250 per month. These plans include additional features like custom branding and dedicated support.

Best for International Businesses

Payment Rails is best suited for businesses that require global payment processing and compliance with international payment regulations. The software is particularly useful for businesses that need to send payments to vendors, contractors, or employees in different countries and currencies.

Highlights and Hidden Gems of Payment Rails

- Global payment processing: Payment Rails offers global payment processing, allowing businesses to send payments to over 220 countries and territories worldwide. The software supports a range of currencies and payment methods, making it easier for businesses to make cross-border payments.

- Compliance with international payment regulations: Payment Rails complies with international payment regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements. This ensures that businesses can send payments securely and competently, reducing the risk of fraud or non-compliance.

- Customizable branding: Payment Rails offers customizable branding features, allowing businesses to add branding and logos to their payment communications. This can help businesses maintain a professional image and improve their brand recognition.

Disadvantages and Limitations of Payment Rails

- Limited integrations: While Payment Rails offers integrations with popular accounting software like QuickBooks and Xero, it does not offer integrations with other types of software that businesses may require, such as inventory management or project management tools.

- No option for credit card payments: Payment Rails does not offer the option to send payments via credit card, which may be a disadvantage for businesses that prefer that payment method.

6. Zoho Books

Pricing: Free Plan Available

Their pricing plans start at $9 per organization per month for the Basic plan, which includes basic features like invoicing and expense tracking, and go up to $29 per organization per month for the Professional plan, which includes advanced features like inventory management and project management. Zoho Books also offers a free plan for businesses that require basic accounting features with limited functionality and access to certain features.

Best for SMBs that Use Advanced Features

Zoho Books is best suited for small and medium-sized businesses that require advanced accounting features. The software is also an excellent choice for businesses that require customizable invoicing and time-tracking features, as Zoho Books offers a range of options for those functions.

Highlights and Hidden Gems of Zoho Books

- Bank rules: Zoho Books offers advanced bank rule features that allow businesses to automate their bank reconciliation process. Users can create rules that automatically categorize transactions and apply them to the appropriate accounts, saving time and reducing the risk of errors.

- Sales orders: Zoho Books offers advanced sales order features that allow businesses to track their orders from start to finish. Users can create and send sales orders to customers and convert them into invoices once the order is fulfilled. This can help businesses stay on top of their sales and inventory levels.

- Automated workflows: Zoho Books offers automated workflow features that allow businesses to automate their accounting processes. Users can create custom workflows that automate tasks like sending invoices, issuing refunds, and generating reports, reducing the need for manual data entry.

Disadvantages and Limitations of Zoho Books

- Learning curve: While Zoho Books is user-friendly, it still requires some accounting knowledge and expertise to set up and use. This may be a disadvantage for businesses that do not have a dedicated accounting team or personnel.

- Limited integrations: While Zoho Books offers integrations with popular software like Stripe and PayPal, it may not offer integrations with other types of software that businesses may require, such as inventory management or project management tools.

7. Zoho Expense

Pricing: Free Plan Available

Their pricing plans start at $0 per month for the Free plan, which includes basic features like expense tracking, reporting, and receipt scanning, and go up to $8 per user per month for the Premium plan, which includes advanced features like project tracking and custom integrations. Zoho Expense also offers a Corporate plan for larger businesses that require custom pricing and additional features.

Best for Businesses with Mobile Employees

Zoho Expense is best suited for businesses of all sizes that require advanced expense tracking and management features. The software is particularly useful for businesses with mobile employees, as it offers a mobile app that allows users to easily track and submit expenses on the go.

Highlights and Hidden Gems of Zoho Expense

- Automated workflows: Zoho Expense offers automated workflow features that allow businesses to automate their expense tracking and management processes. Users can create custom workflows that automate tasks like expense approvals and reimbursements, reducing the need for manual data entry.

- Credit card integration: Zoho Expense offers integrations with popular credit card providers like Visa and Mastercard, allowing users to easily import their credit card transactions into the software. This can help businesses stay on top of their expenses and avoid errors or duplicates.

- Customizable expense policies: Zoho Expense offers customizable expense policies that allow businesses to set up their own rules and guidelines for employee expenses. This can help businesses ensure that expenses are being submitted and approved according to their own policies and requirements.

- Expense report templates: Zoho Expense offers a range of customizable expense report templates that make it easy for businesses to create professional-looking reports quickly and efficiently. Users can customize the templates with their branding and add fields as needed.

Disadvantages and Limitations of Zoho Expense

- Limited expense receipt capacity: While Zoho Expense allows users to scan and attach expense receipts to their entries, the software has a limited capacity for the number of receipts that can be attached. This can be a disadvantage for businesses with a high volume of receipts that need to be stored and accessed in the future.

- Limited customization options for certain features: While Zoho Expense offers a range of customizable options for many of its features, some features may have limited customization options. This can disadvantage businesses that require more flexibility and customization in their expense tracking and management processes.

8. ProfitBooks

Pricing: Free Plan Available

Their pricing plans start at $15 per month for the Basic plan, which includes basic features like invoicing and expense tracking, and go up to $50 per month for the Pro plan, which includes advanced features like inventory management and project management. ProfitBooks also offers a free plan for businesses that require basic accounting features with limited functionality and access to certain features.

Best for Startups or Growing Businesses

ProfitBooks is best suited for startups and growing businesses because it offers a range of features that can help these types of businesses manage their finances more efficiently. The software is affordable, easy to use, and offers advanced features that can help businesses stay on top of their finances and control their costs.

Highlights and Hidden Gems of ProfitBooks

- Project management: ProfitBooks offers advanced features, allowing businesses to track project costs and profitability in real-time. The software includes features like project budgeting, timesheets, and invoicing, making it easier for businesses to manage their projects and control their costs.

- Inventory management: ProfitBooks offers advanced inventory management features, allowing businesses to track their inventory levels and movements in real-time. The software includes features like stock adjustments, transfers, and valuation, making it easier for businesses to manage inventory and control costs.

- Customizable invoicing: ProfitBooks offers customizable invoicing features that allow businesses to create professional invoices and customize them with their branding. Users can add logos, colors, and custom fields to their invoices, making them more personalized and professional.

- Time tracking: ProfitBooks offers time tracking features that allow businesses to track their employees’ time and billable hours in real-time. This can help businesses stay on top of employee productivity and make informed decisions about pricing and profitability.

Disadvantages and Limitations of ProfitBooks

- Limited reporting options: While ProfitBooks offers a range of customizable reporting options, it may have limited reporting options for certain types of data or transactions. This can disadvantage businesses that require more advanced reporting and analysis features.

- Limited international support: ProfitBooks may have limited international support, including limited currency and language options. This can disadvantage businesses operating across different countries and regions, as it may not support their accounting needs.

9. Xero

Pricing Starts at $11/month

Their pricing plans start at $11 per month for the Early plan, which includes basic features like invoicing and expense tracking, and go up to $62 per month for the Established plan, which includes advanced features like project management and multi-currency support. Xero also offers a free trial for new users to test out the software before committing to a paid plan.

Best Comprehensive Accounting Solution

Xero is best suited for small and medium-sized businesses that require a comprehensive and user-friendly accounting solution. The software is particularly well-suited for businesses that require advanced features like project management, inventory management, and multi-currency support.

Highlights and Hidden Gems of Xero

- Bank reconciliation: Xero offers advanced bank reconciliation features that allow businesses to easily reconcile their bank transactions with their accounting records. The software includes features like bank rules, automatic matching, and batch payments, making it easier for businesses to keep their financial records current.

- Multi-currency support: Xero offers advanced multi-currency support, allowing businesses to manage their finances across different currencies and regions. The software includes multi-currency invoices, exchange rate updates, and reports, making it easier for businesses to manage their finances across borders.

- Customizable dashboards: Xero offers customizable dashboards that allow businesses to create a personalized view of their financial data. Users can add custom widgets and graphs to their dashboards, making monitoring key metrics and making informed decisions easier.

Disadvantages and Limitations of Xero

- Limited payroll features: While Xero offers payroll functionality, its payroll features may be limited compared to other accounting software options on the market. This can be a disadvantage for businesses that require more advanced payroll features, such as employee self-service and benefits management.

- Limited customer support: While Xero offers a range of online support resources, its customer support may be limited compared to other accounting software options on the market.