8 Best Automated Accounting Software

In the fast-paced world of business, keeping track of finances and accounting is crucial. But as the volume of financial transactions grows, manual bookkeeping becomes increasingly tedious, time-consuming, and error-prone. That’s where automated accounting software comes in. These innovative tools can help businesses of all sizes manage their finances with greater efficiency and accuracy, saving time and reducing the risk of costly mistakes. In this article, we’ll take a closer look at the top eight best-automated accounting software solutions on the market today, exploring their features, benefits, and how they can help your business stay on top of its finances. Whether you’re a small startup or a large enterprise, there’s an automated accounting software solution out there that can help you streamline your financial management and take your business to the next level.

Best Automated Accounting Software

- Intuit QuickBooks

- Microsoft Dynamics GP

- Xero

- Oracle NetSuite

- FreshBooks

- SAP Business One

- Zoho Books

- Sage Intacct

1. Intuit QuickBooks

Pricing Starts at $25/month

QuickBooks is available in several pricing plans, including Simple Start, which is priced at $25 per month, Essentials, which costs $50 per month; and Plus, which is $80 per month. In addition to these plans, QuickBooks also offers an Advanced plan for larger businesses with more advanced financial needs. The pricing for this plan varies depending on the number of users and the specific features required.

Best All-in-One Accounting Solution

It is an ideal choice for businesses that are looking for an all-in-one solution that can help them manage their finances, track their expenses, and create professional invoices. QuickBooks is particularly popular among businesses in industries such as retail, e-commerce, and professional services, where accurate and up-to-date financial information is critical.

Highlights and Hidden Gems of Intuit QuickBooks

- Bank Feed: QuickBooks has a bank feed feature that automatically downloads and categorizes bank and credit card transactions, saving businesses time in data entry and reconciliation.

- Recurring Transactions: QuickBooks allows users to set up recurring transactions, such as monthly rent or utilities, which are automatically recorded, eliminating the need for manual data entry each month.

- Invoice Automation: QuickBooks allows users to set up automatic invoicing for recurring payments, such as monthly subscriptions or retainers, which can be sent to customers automatically without the need for manual intervention.

- Expense Tracking: QuickBooks can automatically track and categorize expenses, allowing users to monitor spending easily and identify areas for cost savings.

Disadvantages and Limitations of Intuit QuickBooks

- Learning Curve: While QuickBooks has a user-friendly interface, it can take some time to learn how to use the software effectively.

- Customization Limits: While QuickBooks offers customization options, there are limitations to what can be customized, and some businesses may find the software does not meet all their unique needs.

2. Microsoft Dynamics GP

Pricing Starts at $185/user/month

The pricing for Microsoft Dynamics GP can vary depending on the specific needs and requirements of a business. The typical range of the software is $185 to $300 per user per month. Dynamics GP is licensed through a partner network, meaning businesses must work with a certified Dynamics GP partner to purchase and implement the software. The cost of Dynamics GP can include licensing fees, implementation fees, and ongoing maintenance and support fees.

Best for Complex Businesses

Microsoft Dynamics GP is an ERP software solution that is best suited for small to medium-sized businesses in a variety of industries, including manufacturing, distribution, retail, and professional services. It is an ideal choice for businesses that require a comprehensive solution to manage their financials, supply chain, inventory, and human resources. Dynamics GP is particularly useful for businesses that have complex supply chains, multiple locations, and project management needs.

Highlights and Hidden Gems of Microsoft Dynamics GP

- Workflow Automation: Microsoft Dynamics GP offers powerful workflow automation features that can streamline accounting processes, including accounts payable and accounts receivable.

- SmartList: SmartList is a reporting tool that allows users to create custom reports by combining data from different modules within Microsoft Dynamics GP. This feature is incredibly flexible, and users can create a wide range of reports, from simple lists to complex financial statements.

- Bank Reconciliation: Dynamics GP has an automatic bank reconciliation feature that can save businesses time and reduce errors by automating the matching of bank transactions to accounting records.

- Financial Reporting: Dynamics GP offers a variety of financial reporting tools, including pre-built reports and customizable report templates, which can automate financial reporting and save businesses time in data entry and analysis.

- Integration with Office 365: Dynamics GP integrates with Office 365, allowing users to automate accounting tasks directly from their email, calendar, and other Office applications.

- Multi-Currency Management: Dynamics GP offers multi-currency management, allowing businesses to automate currency conversion and exchange rate updates.

Disadvantages and Limitations of Microsoft Dynamics GP

- Complex Implementation: Dynamics GP can be complex to implement, requiring significant time and resources for setup and configuration.

- Limited Cloud Capabilities: While Dynamics GP has some cloud capabilities, it may not be as robust as other cloud-based accounting solutions, limiting the flexibility and accessibility for businesses.

3. Xero

Pricing Starts at $11/month

Xero is available in three pricing plans, including Early, Growing, and Established, with prices ranging from $11 per month to $62 per month. The Early plan is the most basic, allowing for up to 20 invoices and five bills to be processed per month. The Growing plan is designed for growing businesses and allows for unlimited invoicing and bills. The Established plan is the most comprehensive, offering advanced features such as multi-currency and expenses. Xero also offers a free trial for new users, allowing businesses to test the software before committing to a paid plan.

Best for Small to Medium Businesses

Xero is an accounting software solution that is best suited for small to medium-sized businesses that require a cloud-based accounting system with powerful automation capabilities. It is an ideal choice for businesses that require a comprehensive solution to manage their finances, expenses, invoicing, and payroll while also automating routine accounting tasks. Xero is particularly popular among businesses in industries such as professional services, retail, e-commerce, and nonprofit, where accurate and up-to-date financial information is critical.

Highlights and Hidden Gems of Xero

- Bank Feed: Xero offers bank feed integration with over 200 financial institutions, allowing businesses to automatically import and categorize bank transactions, saving data entry and reconciliation time.

- Invoice Automation: Xero offers automatic invoicing for recurring payments, such as monthly subscriptions or retainers, which can be sent to customers automatically without manual intervention.

- Expense Tracking: Xero can automatically track and categorize expenses, allowing users to monitor spending easily and identify areas for cost savings. Xero offers the ability to set up expense rules, automatically categorizing expenses based on predefined criteria, such as the vendor or the expense category.

- Integration with Third-Party Apps: Xero integrates with a variety of third-party apps, such as Shopify, Square, and PayPal, which can automate tasks like inventory management and payment processing.

Disadvantages and Limitations of Xero

- Limited Features in Lower Tiers: The lower pricing tiers of Xero offer fewer features and functionalities compared to the more expensive plans, which may not be sufficient for larger or more complex businesses.

- Lack of Integration with QuickBooks: While Xero integrates with many third-party apps, it does not integrate with QuickBooks, which may be a disadvantage for businesses that rely on QuickBooks for other accounting tasks.

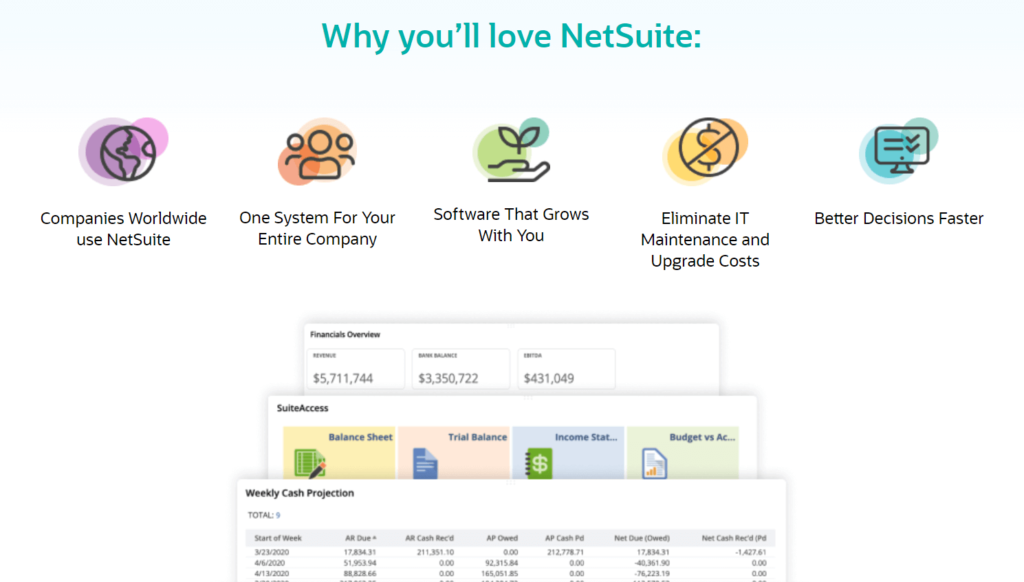

4. Oracle NetSuite

Pricing Varies, Based on Consultation

NetSuite pricing is based on a subscription model, with costs that can include licensing fees, implementation fees, and ongoing maintenance and support fees. The total cost of NetSuite will depend on the size of the business, the number of users, the required features and functionality, and the level of customization needed. Typical NetSuite implementations may cost upwards of $25,000.

Best for Complex Businesses that Require Customizable Solution

Oracle NetSuite is an ERP software solution that is best suited for medium to large-sized businesses across a wide range of industries, including retail, e-commerce, manufacturing, distribution, and professional services. It is an ideal choice for businesses that require a comprehensive and highly customizable solution to manage their financials, supply chain, inventory, and human resources. NetSuite is particularly useful for businesses that have complex supply chains, multiple locations, and project management needs.

Highlights and Hidden Gems of Oracle NetSuite

- SuiteFlow Tool: SuiteFlow is a workflow automation tool that allows businesses to automate their business processes in a flexible and customizable way. With SuiteFlow, users can design and automate workflows that involve multiple steps, such as approval processes, data entry, and record updates.

- SuiteSuccess Methodology: NetSuite offers a comprehensive implementation methodology called SuiteSuccess, which includes preconfigured dashboards, reports, and workflows to help businesses get up and running quickly.

- Powerful Automation: NetSuite offers powerful automation capabilities that can streamline accounting processes, such as accounts payable and accounts receivable, and automate routine tasks, such as bank reconciliations and invoice processing.

- Real-Time Visibility: NetSuite offers real-time visibility into business performance, with dashboards and reports that provide insights into financials, sales, and inventory.

Disadvantages and Limitations of Oracle NetSuite

- Cloud-Based Limitations: As a cloud-based solution, NetSuite may have limitations for businesses with limited or unreliable internet connectivity.

- Customization Complexity: While NetSuite offers customization, its highly customizable nature can make it complex and challenging for businesses to modify the software to meet their unique needs without significant technical expertise.

5. FreshBooks

Pricing Starts at $4.50/month

FreshBooks is available in four pricing plans, including Lite, Plus, Premium, and Select, with prices ranging from $4.50 per month to $15 per month for the Lite plan and from $50 per month to $500 per month for the Select plan. The Lite plan is the most basic, allowing for up to 5 clients and unlimited invoicing. The Plus plan is designed for growing businesses and allows for up to 50 clients. The Premium plan offers advanced features such as project management and team timesheets, while the Select plan is designed for large businesses with custom features and a dedicated account manager.

Best for SMBs with Recurring Revenue

FreshBooks is an accounting software solution that is best suited for small to medium-sized businesses, freelancers, and self-employed professionals. It is an ideal choice for businesses that require powerful automation capabilities that can help streamline financial management tasks. FreshBooks is particularly popular among businesses in industries such as creative services, consulting, and trades, where accurate and up-to-date financial information is critical. Additionally, FreshBooks is a good choice for businesses that have recurring revenue streams, as it offers powerful invoicing and recurring billing features.

Highlights and Hidden Gems of FreshBooks

- Automatic Invoicing: With automatic invoicing, businesses can set up recurring invoices that are automatically sent to customers at regular intervals, such as weekly, monthly, or quarterly. This can be particularly useful for businesses with subscription-based revenue streams or regular billing cycles. Automatic invoicing also ensures that invoices are sent on time, reducing the risk of late payments and improving cash flow.

- Time Tracking: FreshBooks offers time tracking capabilities, which can help businesses automate billing and accurately track billable hours for clients.

- Automatic Expense Categorization: This allows businesses to track and categorize expenses automatically. This feature can save businesses time in data entry and ensure consistency in expense tracking across the organization. With FreshBooks, users can set up rules that automatically categorize expenses based on predefined criteria, such as the vendor or the expense category.

Disadvantages and Limitations of FreshBooks

- Limited Functionality: FreshBooks may be limited in terms of functionality compared to other accounting software solutions, which may make it less suitable for larger or more complex businesses.

- Limited Reporting Capabilities: FreshBooks offers a limited number of pre-built reports, which may not meet the needs of businesses with more sophisticated reporting requirements.

6. SAP Business One

Pricing Ranges from $56/month to $108/month, Per User

The pricing ranges from $56 per user per month for a Limited License to $108 per user per month for a Professional License. The total cost of SAP Business One will depend on factors such as the size of the business, the number of users, the required features and functionality, and the level of customization needed. SAP Business One is typically more expensive than other accounting software solutions, as it is a comprehensive and highly customizable solution that can support a wide range of business processes beyond accounting.

Best for Retail, E-Commerce, Manufacturing, or Professional Services

SAP Business One is an ERP software solution that is best suited for small to medium-sized businesses across a wide range of industries, including retail, e-commerce, manufacturing, distribution, and professional services. It is an ideal choice for businesses that require a comprehensive and highly customizable solution to manage their financials, supply chain, inventory, customer relationship management (CRM), and human resources.

Highlights and Hidden Gems of SAP Business One

- A/P and A/R Automation: SAP Business One offers powerful automation capabilities that can help businesses streamline accounting processes, such as accounts payable and accounts receivable, and automate routine tasks, such as bank reconciliations and invoice processing.

- Advanced Inventory Management: SAP Business One offers advanced inventory management features, including automatic inventory updates, real-time inventory tracking, and integration with barcode scanners and RFID technology, which can automate inventory management and reduce errors.

- Integration with Third-Party Apps: SAP Business One integrates with a wide variety of third-party apps, such as Shopify, Salesforce, and HubSpot, which can streamline the automation of accounting tasks through other applications.

- Real-Time Visibility: SAP Business One offers real-time visibility into business performance, with dashboards and reports that provide insights into financials, sales, inventory, and other key performance indicators.

Disadvantages and Limitations of SAP Business One

- Integration Complexity: Integration with third-party apps can be complex and may require technical expertise.

- User Roles and Permissions: SAP Business One may be limited in user roles and permissions, which may not be suitable for larger businesses with more complex organizational structures.

7. Zoho Books

Pricing: Basic Plan for One User is Free

Zoho Books is available in four pricing plans, including Basic, Standard, Professional, and Professional Plus, with prices ranging from $0 per month to $50 per month for the Professional Plus plan. The Basic plan is free and allows for one user and up to 25 contacts. The Standard plan allows for up to 3 users, while the Professional plan allows for up to 10 users. The Professional Plus plan offers advanced features such as inventory management and purchase order management and allows for up to 10 users.

Best for Smaller Service-Based Businesses

Zoho Books is particularly popular among service-based businesses such as consultants, freelancers, and digital agencies, where accurate and up-to-date financial information is critical. Additionally, Zoho Books is a good choice for businesses that have recurring revenue streams, as it offers powerful invoicing and recurring billing features. Zoho Books may not be as well-suited for larger businesses with more complex accounting needs, as it may not have the same level of scalability and customization as other enterprise-level accounting software solutions.

Highlights and Hidden Gems of Zoho Books

- Automated Invoicing: Zoho Books offers powerful invoicing capabilities, including automatic invoicing and recurring billing, allowing businesses to automate routine invoicing tasks and improve cash flow.

- Time Tracking: Zoho Books offers time tracking capabilities, which can help businesses automate billing and accurately track billable hours for clients.

- Expense Tracking: Zoho Books offers a powerful solution to help businesses monitor spending and optimize costs. With Zoho Books, users can easily track and categorize expenses, set up recurring expenses, and attach receipts to transactions. Zoho Books can also automatically import credit card and bank transactions and categorize them into relevant expense accounts.

- Automated Bank Feeds: Zoho Books offers automated bank feeds, which can automatically import bank transactions and reconcile bank accounts, reducing the need for manual data entry and improving accuracy.

Disadvantages and Limitations of Zoho Books

- Limited Reporting Capabilities: Zoho Books offers a limited number of pre-built reports, which may not meet the needs of businesses with more sophisticated reporting requirements.

- Limited Customization: Zoho Books may be limited in terms of customization options, making it difficult for businesses with unique accounting needs to tailor the software to their specific requirements.

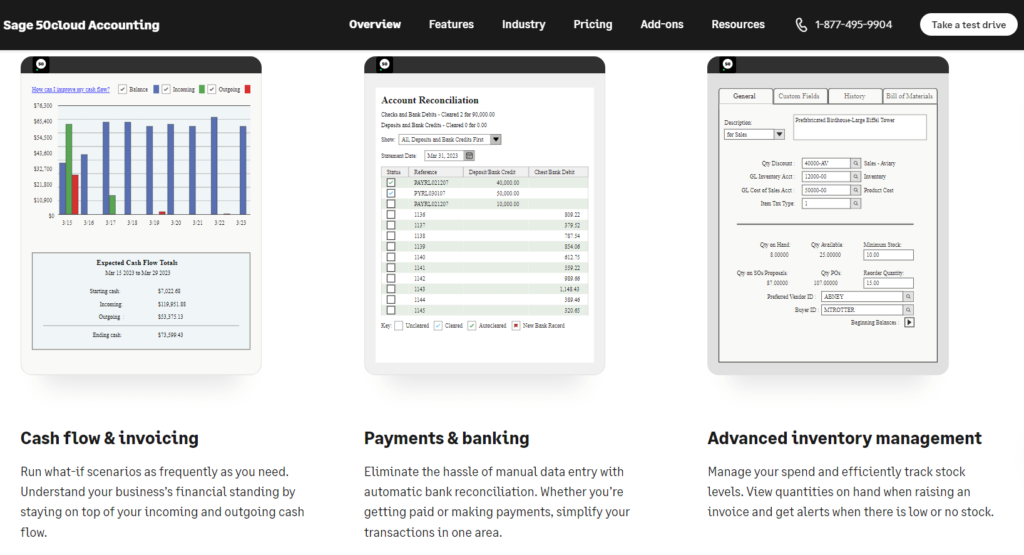

8. Sage Intacct

Pricing Ranges Upwards of $15,000 Annually

No pricing is available on this software’s website, but the price reportedly ranges from $15,000 to $60,000 annually. Sage Intacct pricing is based on a subscription model, with fees charged on a per-user, per-month basis. The total cost of Sage Intacct will depend on factors such as the size of the business, the number of users, the required features and functionality, and the level of customization needed.

Best for Complex Businesses with Project-Based Revenue

Sage Intacct is an accounting software solution that is best suited for medium-sized to large businesses, particularly those with complex financial management needs. It is an ideal choice for businesses that require a comprehensive, cloud-based accounting system that can support multiple entities, locations, currencies, and revenue streams.

Sage Intacct is particularly well-suited for businesses with project-based revenue streams, as it offers powerful project accounting capabilities, including project billing, project planning, and resource allocation.

Highlights and Hidden Gems of Sage Intacct

- Accounts Payable Automation: Sage Intacct’s accounts payable automation capabilities can help businesses automate invoice processing, reduce data entry errors, and speed up the approval process. With automated workflows and alerts, Sage Intacct can help ensure invoices are processed accurately and on time.

- Accounts Receivable Automation: Sage Intacct’s accounts receivable automation capabilities can help businesses automate billing, track customer payments, and manage collections. With automated workflows and alerts, Sage Intacct can help ensure that invoices are sent on time, payments are received on time, and collections are managed effectively.

- Bank Reconciliation Automation: Sage Intacct’s bank reconciliation automation capabilities can help businesses automate the process of reconciling bank accounts, reducing the need for manual data entry and improving accuracy. With automatic bank feeds and matching rules, Sage Intacct can help ensure bank transactions are accurately recorded and reconciled.

- Inventory Management Automation: Sage Intacct’s inventory management automation capabilities can help businesses automate inventory tracking, reduce errors, and optimize inventory levels. With automatic inventory updates and real-time tracking, Sage Intacct can help businesses ensure they have the right products in stock at the right time.

Disadvantages and Limitations of Sage Intacct

- Integration Complexity: Integration with third-party apps can be complex and may require technical expertise to implement.

- Limited User Roles and Permissions: Sage Intacct may be limited in terms of user roles and permissions, which may not be suitable for larger businesses with more complex organizational structures.